Liberal Prime Minister Morrison was the financial source of Liberal Premier Berejiklian’s Micro Business Grant

What most grant recipients targeted by the Minns Mafia grant clawback may forget is that all the original funding for the ‘2021 COVID-19 Micro Business Grant‘ came from the federal Liberal-National coalition government in Canberra. It did NOT come from NSW Treasury.

The total grant applications assessed, approved, paid out amounted to $781.1 million!

What a huge alluring carrot to corrupt bureaucrats and pollies to try to clawback!

Mind you, the reported 13,000 instances of fraud of this Grant amounting to $20 million of that was actually found to be by professional cyber-criminal syndicates, which had so embarrassed Service NSW back in November 2021 that they reported all this to the NSW Police Force’s Financial Crimes Squad. Read below:

We wonder then what happened to that Strikeforce Sainsbury Investigation Report went?

This report was never made public, yet the defrauded $20 million+ was public money stolen by real cyber-criminal thieves.

This important report needs to be sourced from the NSW Police’s Financial Crimes Squad by the Opposition in NSW Parliament from the incumbent Minns NSW Government through Freedom of Information (F.O.I.)

We note that in NSW, F.O.I. since 2009 had been officially re-branded ‘GIPA’ [The Government Information (Public Access) Act 2009] for some bureaucratic justification.

Under the current NSW Labor ‘Minns Mafia‘, the ongoing extortionate attempts by Service NSW ‘cost-recovery’ Godfather Greg Wells and his ring-in anonymous debt collectors to claw back the grant from ordinary ‘mum and dad’ micro businesses continues.

It’s unconscionably being done by ‘OrWellsian‘ fabrication of the grant into a state debt. It’s being done by hook and by crook – all subterfuge debt collecting tactics outside this Grant’s original Guidelines, and original Terms and Conditions.

But that money, if clawed back, isn’t returning to Canberra by Wells’ anonymous debt collectors. Instead, the mafiosi dosh takings are to be handed over to Treasurer Daniel Mookhey for Minns’ state consolidated revenue ‘spendies’.

This is why the clawback is criminal extortion. It is Robodebt 2.0 !

We recommend to all grant recipients being targeted by Service NSW clawback extortionate ROBODEBT2.0 scam to complain to their FEDERAL member of Australian Parliament !

Tell your Federal member of Parliament that this grant was funded by the Federal Government in the spirit of providing desperately needed financial compensation for the mandatory socio-economic lockdown at the time, which in this case were thousands of micro businesses across New South Wales.

Tell your Federal member of Parliament that the payments were duly assesses, approved and paid by Service NSW on behalf of the NSW LNP Berejiklian Government of the day. The money belongs entirely to those grant recipients, most of whom have used that money to stay afloat.

Tell your Federal member of Parliament about this clawback extortion.

That money does not belong to the Federal Government, and it most certainly does NOT belong to the Minns Mafia!

Minns Mafia

Service NSW Godfather Wells knows that by going after the easy ‘low-hanging fruit‘ for the picking, the many genuinely struggling ‘mum and dad’ micro business owners who received the grant compensation (up to $15214 each) won’t have the wherewithal to fight big government extortion.

This is especially when he hands the debt collection over to his colleague in Revenue NSW.

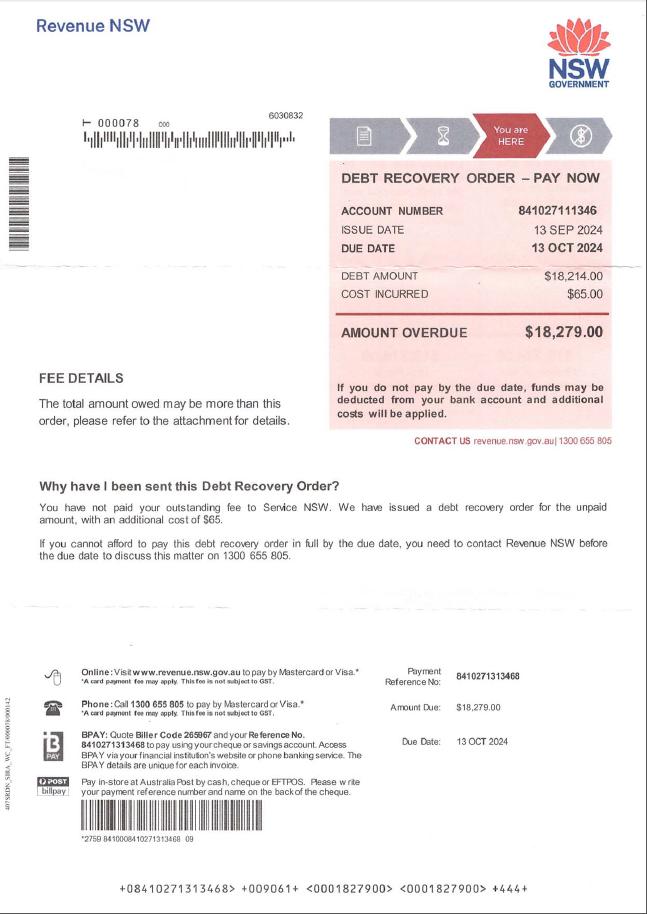

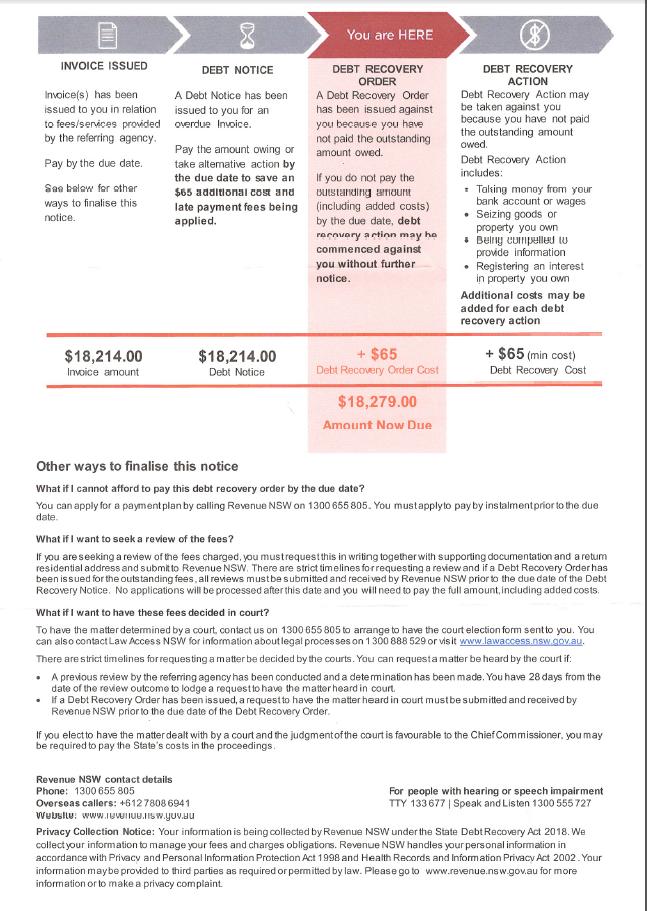

Check this example out…

NOTE: This Revenue NSW invoice on behalf of Service NSW (wink wink) totals $18,279. But it’s for a fabricated debt from a Service NSW grant of $15214. Greg Wells fessed up to the victim over the phone that Service NSW had done an ‘AI’ typo. But then it conveniently forgot to fix it or tell their brothers-in-arms at Revenue NSW. They just treated it as a $3000 tip.

The $781.1 million paid out to the total of 63,009 of the 82,497 grant applicants came from Liberal Prime Minister Scott Morrison provided to his Liberal counterpart Premier Gladys Berejiklian in New South Wales.

It was political because the Liberal National Coalition Party and both Federal level and at New South Wales level had been exposed publicly of allowing the foreign China-based Coronavirus pandemic to enter Australia unchecked and flourish. This caused thousands of virus cases and hundreds of deaths and created a governmental reactionary policy mandating total socio-economic lockdown from February 2020.

Those in NSW may recall that on Thursday 19th March 2020, the Ruby Princess cruise ship docked in Sydney with dozens of undiagnosed Coronavirus cases onboard.

Almost 2,700 passengers – some coughing and spluttering – were allowed to leave the ship at Sydney Harbour, catching trains, buses and even overseas flights to get home. More than 130 people from the cruise have now tested positive, making it the biggest single source of infections in Australia.

Cruise ships are a biological ‘petri dish’ for spreading viruses – onboard air-conditioning gets recirculated

The abject failure of Australian Immigration (renamed ‘Border Force’) and of Australian Quarantine (renamed ‘Biosecurity’) meant that for a virus with no vaccine, the highly infectious contagion once inside a country would quickly morph into a national pandemic causing mass case infections and deaths.

To prevent that, the last resort at a state level was to legislate mandatory blanket socio-economic lockdown – stay at home or cop a $5000 fine by state police!

Businesses consequentially suffered financial catastrophe – denied trade and denied revenue. After 18 month of lockdown, by mid-2021, the unleashing of the UN-labelled ‘Delta strain‘ of the Coronavirus had caused desperate emergency times for both federal and state/territory governments across Australia, particularly in the densely populated capital cities.

The following media articles are reproduced to remind grant recipients in NSW about the original truth of where this compensatory funding had come from.

‘Sydney businesses and workers thrown $5b virus lifeline’

~ 13 Jul 2021, AFR

“Small and medium businesses in NSW will be eligible for weekly cash payments of up to $10,000, and adversely affected workers will receive between $375 and $600 a week, in an escalation of support measures the federal government says will be the new national template for lockdowns.

The measures, which will cost the NSW and federal governments an estimated $5 billion between them, were unveiled on Tuesday, ahead of an announcement by NSW Premier Gladys Berejiklian that the lockdown of Greater Sydney will not be lifted on Friday but will enter a fourth week, and most likely longer.”

Supporting NSW businesses through to reopening

~ 30 September 2021, by NSW Treasurer Perrottet

‘The Morrison and Berejiklian Governments will continue supporting thousands of small and medium-sized businesses until New South Wales is expected to reach 80 per cent vaccination.

Consistent with the National Plan, the Commonwealth will continue to co-fund the JobSaver program, with funding to taper when New South Wales meets its vaccination targets.

When the state’s vaccination rate reaches 70 per cent of the eligible population, JobSaver payments will taper from the current payment rate equivalent to 40 per cent of weekly payroll to 30 per cent of weekly payroll. This is anticipated to occur by 10 October.

From 10 October to 23 October, the minimum and maximum weekly payments for employing businesses will be reduced by 25 per cent to $1,125 and $75,000 weekly and grants to be 30 per cent of weekly payroll. The grant for sole traders will reduce to $750.

Once New South Wales reaches a vaccination rate of 80 per cent, the Commonwealth’s contribution to the JobSaver program will cease, in line with the National Plan for Reopening. This is anticipated to occur by 31 October.

The New South Wales Government will later today announce details of further support to businesses beyond this period.

The Federal Treasurer Josh Frydenberg said the ongoing support comes on top of the Morrison Government’s more than $52 billion in direct economic support to New South Wales households and businesses since the start of the pandemic.

Federal Treasurer Frydenberg:

“The Morrison Government understands the significant impact lockdowns and border closures have had on small and medium businesses across New South Wales and we are encouraged by the State Government’s reopening roadmap in line with the plan agreed at National Cabinet.

The jointly funded JobSaver program tapers as the state reaches 70 per cent full vaccination rate, consistent with the easing of restrictions.

The Commonwealth will cease funding state business support programs, including JobSaver, at 80 per cent full vaccination in line with the National Plan for Reopening.

At this point it will be incumbent on the states to provide any necessary targeted business support needed in their jurisdictions relevant to any health restrictions they elect to impose.

We can’t eliminate the virus, we need to learn to live with it in a COVID-safe way. Our economy has bounced back strongly before once restrictions are eased and is well positioned to do so again when lockdowns lift.”

The NSW Treasurer Dominic Perrottet acknowledged the Commonwealth collaboration on the JobSaver program, which had complemented the more than $38 billion in support provided by the NSW Government since the pandemic began in March 2020.

NSW Treasurer Perrottet:

“JobSaver has helped tens of thousands of businesses weather the storm of the Delta outbreak and maintain the vital connection between employers and employees, which will lay the groundwork for our economic recovery as we pivot towards re-opening.

The tapering of the program will ensure we continue to support businesses as we move from response to recovery, giving them much needed support as we focus on the reopening.

The New South Wales Government’s roadmap has laid out a clear plan for getting back to life as we know it and ultimately this will help give businesses the confidence to open up. Sydney and NSW will bounce back, we’ve done it before and we will do it again.

We will announce our comprehensive economic recovery plan in October and have more to say later today about support for NSW businesses as we transition to a brighter summer.”

Increased COVID-19 relief and grants announced for NSW businesses

~ 13 July 2021, by William Buck Australia

‘Scott Morrison, Gladys Berejiklian and Dominic Perrottet have jointly announced a raft of new support measures for the state of NSW in response to the prolonged lockdown in Greater Sydney.

The Federal and NSW Governments will jointly fund a new Small and Medium Business Support Payments for eligible NSW businesses. In addition, the NSW Government has expanded the previously announced grants and introduced some additional support measures for businesses.

In his announcement, the Prime Minister declared that these support packages would be available to any state or territory that experienced an extended lockdown.

We’ve summarised the support available to businesses and how you can access it.

Further details on the eligibility requirements and applications have now been announced.

JobSaver

The Commonwealth and NSW Governments will jointly fund a new Small to Medium Business Support payment called “JobSaver” to eligible (non-employing and employing) entities in NSW, including not for profits.

Additional Commonwealth tax relief was also announced:

Small Business COVID-19 Support Grant

Small businesses (including sole traders) and not-for-profits will be eligible for the 2021 Small Business COVID-19 Support Grant if they meet the criteria below.

Eligibility

Entities will be eligible if they:

- have an ABN registered in NSW or can demonstrate they are physically located and primarily operating in NSW as at 1 June 2021. Only one grant is available for a single ABN

- have total Australian annual wages below $10,000,000 as at 1 July 2020

- have an annual turnover of more than $75,000 for the year ended 30 June 2020

- have not applied for, or received, the Hospitality and Tourism COVID-19 Support Grant (see below), and

• have business costs for which there is no other government support available.

Grant Amount

Eligible businesses receiving either the Small Business Grant or the Hospitality and Tourism Grant can receive:

- $15,000 for a decline in turnover of 70% or more

- $10,500 for a decline in turnover of 50% or more

- $7,500 for a decline in turnover of 30% or more.

The Decline in Turnover is calculated by comparing the business’s turnover over a minimum two-week period after lockdown commenced (26 June ), to a minimum two-week period in June and/or July (not July 2020 as the desired comparison period is specifically June or July 2019 which was pre-COVID).’

[OUR COMMENT: Are we the only ones confused by these arbitrary date ranges?]

‘Applications for the Grant can be made through the Service NSW website from 19 July 2021 with payments expected to be made to eligible businesses in four days from application.’

Micro Business Grant

~ 12 August 2021, by William Buck Australia

The NSW Government has introduced a new grant for smaller micro businesses.

Eligibility

Entities will be eligible if they:

- have annual turnover of more than $30,000 and under $75,000

- Can show a decline in turnover of at least 30%

Grant Amount

Eligible businesses will receive is up to $1500 per fortnight.

How to Apply for the Grant

Applications for the Grant can be made through the Service NSW website from 26 July 2021.

Latest Updates:

[OUR COMMENT: Service NSW started changing the Guidelines and the Terms and Conditions of the Micro Business Grant within a month of it being offered]

30 August | Decline in turnover test for service entities

Service NSW has updated its information for the 2021 COVID-19 Business Grant. The most significant change is the inclusion of an alternative decline in turnover test for eligible group employing entities (i.e. service entities) similar to the rules used for JobKeeper.

NOTE – applications for these grants close at 11:59pm on 13 September 2021

12 August | More detail and changed guidance released for 2021 COVID-19 Business Grant on the Service NSW website

Updates have been made to the Service NSW website for the 2021 COVID-19 Business Grant.

Some of these changes include:

- Additional comparison periods provided

- Defining aggregated annual turnover to include worldwide income of the business, its connected entities and affiliates and not just national income

- Clarification on additional documentation requirements

- Allowing accountants to apply on behalf of their clients.

2021 COVID-19 *Business* Grant

The NSW Government has provided further detail on the 2021 COVID-19 *Business *Grant including greater clarity around the eligibility requirements and the documentation required for application.

The program provides grants of between $7,500 and $15,000 to eligible businesses with annual Australian wages up to $10 million.

Eligibility

Businesses (including sole traders) and not-for-profits will be eligible for the 2021 COVID-19 *Business* Grant if they meet the criteria below.

- have an ABN registered in NSW or can demonstrate that they are physically located and primarily operating in NSW as at 1 June 2021 (only one grant is available for each ABN).

- have total Australian annual wages below $10,000,000 as at 1 July 2020.

- have an aggregated annual turnover of between $75,000 and $50 million (inclusive) for the year ended 30 June 2020.

- have business costs for which there is no other government support available.

- Satisfy the decline in turnover test (set out in the “Grant Amount” section below) due to the Public Health Order.

- For employing businesses, maintain their employee headcount as at 13 July 2021 for the period which the business is receiving payments under this Grant and the JobSaver scheme.

- For non-employing businesses, the business receiving the Grant must be the primary income source for the associated person. Individuals with more than one non-employing business may only claim payment for one business. Non-employing businesses included in the aggregated turnover of an employing business are not eligible to apply.’

References:

(in chronological order)

[1] ‘Sydney businesses and workers thrown $5b virus lifeline‘, 2021-07-13, by Phillip Coorey and Finbar O’Mallon, Australian Financial Review, ^https://www.afr.com/politics/federal/business-worker-supports-boosted-as-lockdown-extension-looms-20210713-p5894u

[2] ‘Increased COVID-19 relief and grants announced for NSW businesses‘, 2021-07-13, by Tim Lyford and Blake Scheffers, William Buck Australia (accounting and business advisory firm), ^https://williambuck.com/news/business/general/increased-covid-19-relief-grants-announced-for-nsw-businesses/

[3] ‘Further detail announced on NSW Government’s 2021 COVID-19 Business Grant‘, 2021-08-12, by Tim Lyford and Blake Scheffers, William Buck Australia (accounting and business advisory firm), ^https://williambuck.com/news/business/general/further-detail-announced-on-nsw-governments2021-covid-19-business-grant/

[4] ‘Supporting NSW businesses through to reopening‘, 2021-09-30, by The Hon Dominic Perrottet MP, New South Wales Treasurer, ^https://ministers.treasury.gov.au/ministers/josh-frydenberg-2018/media-releases/supporting-nsw-businesses-through-reopening