Robodebt 2.0 – Service NSW Grant Clawback Scheme scandal exposed on Channel Nine’s ‘A Current Affair’

Channel Nine’s ‘A Current Affair‘ (ACA) programme has now run two successive episodes on its week-nightly current affairs television programme aired across Australia nationally focusing on Service NSW ‘Robodebt 2.0 Grant Clawback Scheme‘ scandal, since its first episode went to air on 15th August 2024. [A Current Affair Season 2024]

We herein provide convenient podcast access links to view both the two episodes online.

NOTE: Channel Nine requires first a short registration process – free and non-committal to access its TV videos.

ACA Episode 1: ‘Letters sent to small business owners compared to robodebt saga’

This Episode 1 was aired live on TV on Thursday 15th August 2024 on Channel Nine’s A Current Affair at 7pm.

To Play Video, click this link to watch it again via podcast:

https://www.9now.com.au/a-current-affair/season-2024/clip-clzv2inly003a0gq73ag6j50y

The Video’s transcript:

[No video, image only] Letters sent to small business owners compared to [Centrelink’s 2016-2020] Robodebt Scheme

Government-funded grants offered a lifeline to small businesses when they needed it most during the pandemic shutdown, but some businesses are now being hounded to give the money back.

Two years after, Steve received a COVID-19 micro-business grant, the state government decided it wanted the money back. (A Current Affair)

“On the 11th of April 2023, I get a call from ‘Angela’ on my mobile phone saying, ‘I’m from Service NSW, and you’ve been deemed ineligible for having received that grant, we consider that you’ve committed fraud and we want the money back’,” he said.

“I said, ‘Well Angela, if that’s your real name, get a real job’, and I hung up.”

Steve thought the phone call was a scam.

Steve fought the department for a year, until Service NSW withdrew its claim against him. (A Current Affair)

Steve fought the department for a year, until Service NSW withdrew its claim against him.

Almost two years after he received the grant, the state government decided it wanted the money back.

“I’d done nothing wrong,” he said. “I’d complied with all the eligibility criteria and I had all the evidence.”

Steve fought the department for a year, until Service NSW withdrew its claim against him.

But other business owners like Sydney Harbour Bike Tours owner, operator and tour guide Grant are still battling the state government.

“One thing’s for sure, if we’re forced to give back the money, we’ll have to shut our doors,” he said. “They wanted all our company tax returns, business activity statements from 2019 to 2020, letters from our accountant — we provided all of that.”

Sydney Harbour Bike Tours owner, operator and tour guide Grant are still battling the state government. (A Current Affair)

Eighteen months later, Grant was told his company had been deemed ineligible and the money needed to be returned, unless he could prove his business was based in NSW.

“Now we operate as Sydney Harbour Bike Tours, I can’t imagine it’s doing very well with that name down in Melbourne,” he said.

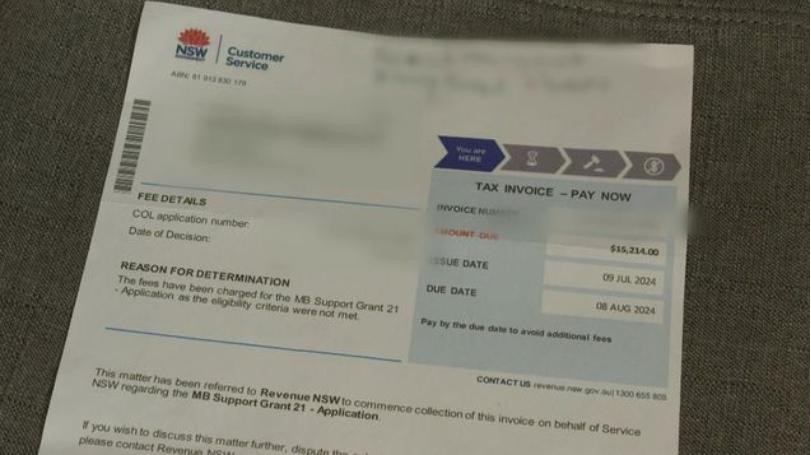

The department was satisfied until a bill arrived in the mail for $15,214 last month.

The aim of the micro-business grant was to provide cash flow and to help people survive lockdown restrictions.

Big businesses received even more support.

Qantas secured $2.7 billion in taxpayer subsidies and despite posting record profits since, former CEO Alan Joyce felt there was no reason for Qantas to repay the funds.

Harvey Norman and franchisees got $22 million in JobKeeper, even though the retailer’s profits more than doubled during the pandemic.

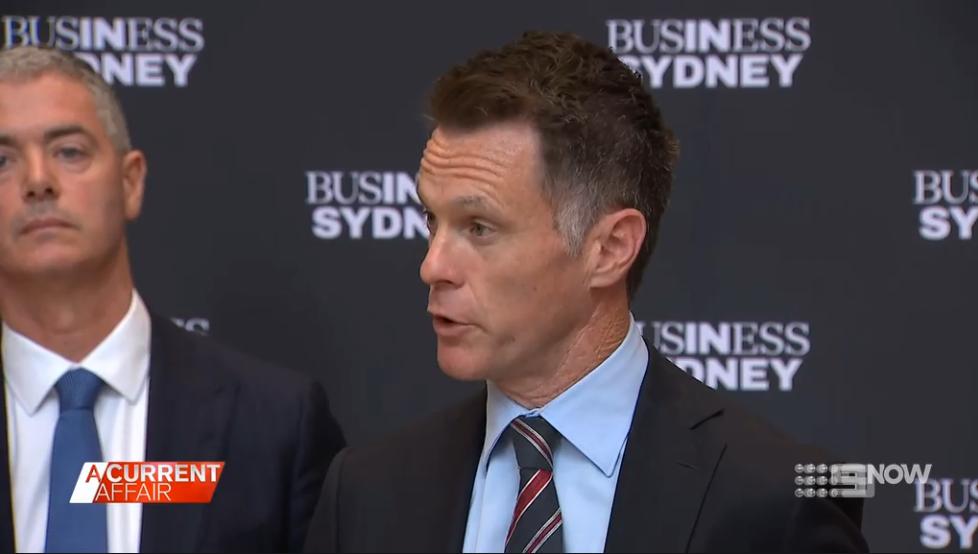

A Current Affair asked NSW Premier Chris Minns why micro-business owners had to return their $15,000.

“I think it’s reasonable for me to say I’d like to know the circumstances before I make a definitive answer in relation to it,” Minns said.

Musician Emile has worked as a sole trader with a small business for the last 30 years.

He has played for top artists and productions including Cirque Du Soleil, Australian Opera, Marcia Hines and Delta Goodrem.

Three years after Emile received a grant, the department sent him the bill.

“Demanding over $15,000 and payable within two and a half weeks,” he said. “I’d have to redraw on my home loan to do it.

“It’s not that long ago we had robodebt and the effects of that and the royal commission. You’d have to be living under a rock to not to have that in your head as a CEO of a government body like Service NSW.

“You’d want to be dotting all your i’s and crossing your t’s.”

Service NSW managing director [CEO] Greg Wells said the department had teams that assessed compliance.

[FACT CHECK: Actually a retrospective ‘reassessment’ some 2+ years after the original 82497 grant applications had been assessed, 63009 of which approved and payments by Service NSW]

“Compliance is part of all of the COVID and stimulus packages,” Wells said. “They’re a necessary component of the programs to make sure we’re getting the funds to the people who are impacted. “We’ve been working with those customers. “Some of those we’ve been able to work through and resolve. “We’ve had 63,000 applications to this grant [FACT CHECK: No! 82497 grant applications of which 63009 approved] , we’re not always going to get it right. “We always want to get it right. We really, really do care.”

Really?

‘Bureaucratic Empathy‘ – is a subsequent term in all this contemptuous bureaucracy we have submitted to Australia’s Macquarie Dictionary for year 2024.

Some small business owners believe there has been a lack of communication.

“This department is just a shambles, you’d get a more efficient system if you went down to the tuck shop at the local primary school,” Emile said.

“Such an abuse of authority and power, the whole thing needs to be shut down,” Steve said.

ACA Episode 2: ‘Sole traders continue to fight NSW government over COVID grant repayments’

This Episode 2 was followed up and aired live on TV on Wednesday 16th October 2024 on Channel Nine’s A Current Affair at 7pm.

To Play Video, click this link to watch it again via podcast:

https://www.9now.com.au/a-current-affair/season-2024/clip-cm2blv2z4000g0hryqm2s25lo

The Video’s transcript:

Episode 2 was aired live on TV on Wednesday 16th October 2024 on Channel Nine’s A Current Affair at 7pm.

(Yet) Premier Chris Minns is standing by the government’s decision to force some sole traders to repay a COVID-19 micro-business grant.

During COVID-19 lockdowns, the state government handed out micro-business grants, many worth $15,000, to businesses with an annual turnover between $30,000 and $75,000.

But three years later the government wants its money back, demanding small business owners repay the grants.

Emile, Steve and Grant spoke to A Current Affair earlier this year.

The government dropped its demands for Steve and Grant to pay back the money they received, but Emile still has to cough up the cash.

“I received a letter just before the last story went to air, probably an hour and a half before it went to air, saying ‘Sorry we’ve looked at your position, and we’ve decided, after we’ve subtracted this, this and this, that you actually fell just below the threshold’,” he said.

Emile’s earnings didn’t reach the $30,000 threshold so he has to pay it back. (Comment: Yet, Emile received Jobkeeper income compensation from the Federal Government and had to include his business’s aggregated income in his reporting to the Tax Office).

But the music industry was one of the first to shut and last to reopen during the pandemic.

“They’ve said that retrospectively three years after the fact,” Emile said. “In that year of COVID we were restricted from working, of course, your income is going to be low.”

During COVID-19 lockdowns, the state government handed out micro-business grants, many worth $15,000, to businesses with an annual turnover between $30,000 and $75,000.

We approached Minns about it two months ago and he wasn’t aware.

When we spoke to him again, the premier said Service NSW was conducting a review for individual businesses.

“I’m aware during COVID there was 63,000 grants given to businesses to keep them afloat, to keep their employees afloat, that amounted to nearly $800 million of tax payer money,” Minns told A Current Affair. “I understand this was made clear to NSW businesses, that they would potentially be subject to auditing at the time.”

Late yesterday, Emile received the call he’d been waiting months for, notifying him that Service NSW had cleared his debt.

But then detectibly in Episode 2 Premier Minns was forthright and rattled to the same ACA reporter’s following questioning about the Service NSW Clawback scandal. Here he is confronting that very questioning in Episode 2. No star-gazing ‘Deer in the Headlights’ this time!

Is the Minns Government serious about supporting businesses in New South Wales?

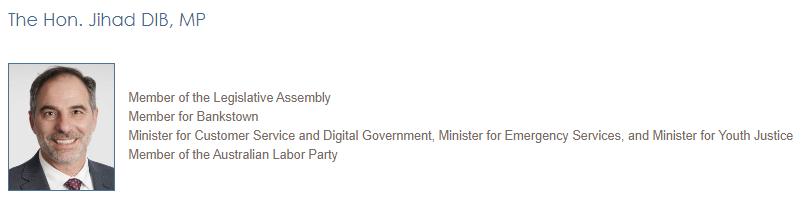

All the while, his Minns Ministry under Service NSW Jihad Dib and Minister for Finance Courtney Houssos are in cahoots hounding around 63000 NSW small business owners unconscionably to repay the NSW Government’s pandemic compensation during unprecedented economic lockdown.

ACA: “Premier Chris Minns is standing by the government’s decision to force some sole traders to repay a COVID-19 micro-business grant.” Aka he back the unconscionable extortion by Greg Wells, and Service NSW Minister Jihad Dib MP remains clueless.

Premier Minns has delegated his Minister Jihad Dib with currently no less that 4 ministerial portfolios. Dib hasn’t got time to scratch himself let alone take on such responsibilities and accountabilities. So he relies on Service NSW henchmen like CEO Greg Wells to tell him what to say publicly

Check out the current NSW Parliament website!

[SOURCE: ‘The Hon. Jihad DIB‘, Parliament of NSW > Members > The Hon. Jihad DIB, MP, ^https://www.parliament.nsw.gov.au/members/Pages/member-details.aspx?pk=110 [Accessed 21-Oct-2024]

It’s a sad state of affairs. Premier Minns knows full well and plays out Albo politics – “nothing to see here!”

QUESTION ON NOTICE: Was Minns hiding under a rock during NSW Lockdown [2020-2022] ?

QUESTION ON NOTICE: Is premier Minns so callous to target innocent mum and dad businesses who have bugger all in the bank?

Never forget such unAustralian pandemic lockdown scenes as this one: