Service NSW Micro Business Grant debt collectors go ‘low-brow’ handover to Revenue NSW. It’s ‘Robodebt Mark 2.0’

Despicably, Service NSW’s contracted debt collectors have started resorting to invoicing Approved Grant Applicants (grant recipients).

This is a sudden escalation of Service NSW grant claw-back scam. Now these immoral bureaucrats are demanding 100% refunds from many grant recipients. Unconscionably, this protected species of abominable bureaucrats are treating the grants now somehow as ‘loans‘.

So they are wildly imaging that all the outstanding paid-out grants from 2021 to compensate the NSW Government’s mandatory pandemic lockdown regime that critically supported thousands of small businesses at the time across New South Wales…is refundable. It’s without any basis nor explanation. It’s just made up, contrived, invented.

It is an absolute government scam under the Minns Mafia.

Service NSW whole dodgy ‘audit’ scheme is bloody corrupt!

This latest ‘roneo invoicing‘ tactic would seem to be a desperate blanket policy by Service NSW senior management (aka CEO Greg Wells and his cohorts) to suddenly impose upon all outstanding grant recipients as from the current new financial year (1st July 2024).

It is Service NSW’s cop-out from is so called ‘audit’ due diligence. It is its senior management contrived ‘fix’ to wind up its grant audit. It is likely coming from on high – Premier Minns and his current Treasurer The Hon. Daniel Mookhey, MLC, following their fraught 2025 Budget’s massive public servant cuts.

Didn’t Service NSW boss Greg Wells read all the news scandal about Centrelink’s IT concocted algorithm debt recovery (2016-2019) and the direct shocking consequences of 2000+ suicides by vulnerable targeted victims on welfare? Clearly not.

He never replied to our two documented direct formal complaints to him against Service NSW harassment behaviour. We trust he retires “to have more time with his family.”

Whereas immediately following the NSW state election with Minns Labor coming to power on 25th March 2023, these debt collectors for Service NSW’s so-called ‘Business Bureau‘, commenced spam contacting recipients of the Micro Business Grant, baselessly accusing hundreds of legitimate recipients as being suddenly ‘ineligible‘. No reason, just sounds good.

Service NSW Business Bureau’s Sheriff Cassandra Gibbens ‘Cassie’ with her deputies – an affirmative action workplace – 100% of quota! Dressed ready to attend grant recipient funerals? [Cassie is a girl’s name of Greek origin, meaning “shining over man”].

Service NSW’s grant payment claw-back is not an ‘audit’ in the professional sense, rather it is a bureaucratic scam dressed up as such. It fails to follow standard and universally accepted Audit definitions and process protocols. [Author: we shall analyse this ‘audit’ in a separate article].

Rather, this Service NSW grant ‘audit’ is characterised by governmental intimidation and harassment of grant recipients. The communication behaviour; its ring in debt collecting contractors acting like a medieval Spanish Inquisition, is a flagrant abuse of Service NSW public service authority and power.

It sets a bad precedent, though that precedent was more likely despicably set by Australia’s federal Liberal (coalition) Government’s Centrelink’s ‘Robodebt’ scam scheme (under MP Turnbull then PM Morrison) which between 2016 and 2019 raised more than half a million inaccurate Centrelink debts from tens of thousands of vulnerable citizens receiving various pension payments.

In this current grant case, dodgy callers and emailers have for over a year been demanding grant recipients ‘show cause’ as to how they are not fraudsters. The fabricated presumption by Service NSW being that most recipients are retrospectively since 2023 being deemed as ineligible for the 2021 COVID-19 Micro Business Grant.

What this Business Bureau is undertaking is basically nullifying the original application process falsely claiming that Service NSW’s original grant approval process was “automatic”. That is, the Business Bureau claims no assessment was conducted of many applications.

This is a retrospective lie and fabricated propaganda to try to justify this ‘audit’ of applications nearly two years later by a different team under a different government.

Nature Trail’s own application experience between submitting its application for this grant to Service NSW in its dedicated website portal on 1st August 2021.

We immediately received from Service NSW the following written email confirmation of its “assessment” process of our submitted application.

Service NSW had then requested from us further supportive documents as part if its grant assessment process. We immediately supplied these by email according to Service NSW, and received written confirmation of their receipt. This communication record we retain in our application records, which are complete and thorough.

Service NSW, then ten days following our application submission, notified us by email of its approved of our application on 11 August 2021.

That Service NSW duly assessed our application is pretty cut and dry.

So, our experience with the approval process is that it was by no means “automatic”. So, for Service NSW debt collectors to 20 months retrospectively to allege that Service NSW’s grant approval process had been “automatic” in order to try to justify its so-called ‘audit’ to us in their calls and emails to us, was a down right furphy.

Essentially, the grant application process was being repeated nearly two years after the grant applications had been assessed, approved and paid out by Service NSW under the previous Berejiklian NSW Liberal (coalition) Government.

Service NSW debt collectors are retrospectively demanding all the grant application supportive evidence be submitted again:

- Comparative profit and loss statements

- Proof of turnover decline

- Comparative tax returns

- Comparative bank statements

- A stat dec from God?

It’s as if Service NSW didn’t keep the original records or supportive evidence for each grant applicant and recipient on record, manual or digital database.

The whole grant administration so seems to be in disarray. It would be Service NSW responsibility, not that of the grant applicants/recipients.

So, subsequently, Service NSW is on the back foot demanding basically that grant applicants re-submit their eligibility criteria evidence. Clearly, Service NSW under CEO Greg Wells f@#ked up big time! We suspect he’s not a detail type.

We note that Liberal Gladys Berejiklian had resigned as NSW Premier back on 30th September 2021. We also note that since the NSW election all this so-called ‘audit’ has been a political stitch up under Chris Minns Labor Government desperately searching for funding, but since the 2013 election, realising Treasury had been splurged on pandemic grants by the guilt-laden accountable, and outgoing NSW Liberal (coalition) government.

The current claw back of the pandemic grant compensation reeks of being politically motivated. One reads the papers. Labor rejecting the previous Liberals’ grant retrospectively after coming to power, finding the NSW Treasury bare and so recruiting a Spanish Inquisition of private debt collectors to target grant recipients. Mostly they work from home, loaned a mobile phone, laptop and internet plan and paid on mainly a commission-only basis with a token retainer.

What to make of this grant handling aftermath by an incoming and opposing political party scrounging around for spare dosh? A bureaucratic mindset of a fabricated ‘audit’…”The Lord giveth and The Lord taketh Away“?

Fair? Hardly.

Service NSW ‘audit’ is can only be political interference and shenanigans, bordering on corrupt bureaucratic conduct.

In reality, most grant recipients are small business owners, who through 2020 and into 2022 were subjected to total economically locked down by the NSW Government, so denied ability to trade for at least two years under the previous governments mandatory closure regime.

Most of these small business owners are honest and law-abiding citizens, on meagre sales turnover and marginal profit normally. Then they were unprecedentedly struggling to make ends meet through this lockdown regime. Most honestly and accurately applied for the 2021 COVID-19 Micro Business Grant after first checking the eligibility guidelines provided on the Service NSW website.

Has Business Bureau’s posse sheriff, Cassandra Gibbens, any moral compass?

An insider has revealed that Gibbens and her department are on a performance bonus, for this debt collection. However, if her Business Bureau under-performs on its financial scam targets, as a senior public servant public fat cat, she’ll be quickly gone-ski under Minns Treasurer Daniel Mookhey’s financial year 2025 budget cuts.

The Business Bureau is set to be shut down anyway. The Minns Government is running out of money. The federal government refused to distribute its allocated GST revenue to NSW Government for financial year 2025 and beyond.

Read this from 14 May 2024: https://www.smh.com.au/politics/federal/the-minns-government-s-worst-budget-fears-have-been-realised-20240508-p5gr2l.html.

A New Financial Year ushers in this new ‘low-brow’ tactic by Service NSW

So from 1st July 2024, the NSW Government enters a new financial year from the Australia Tax Office perspective.

Numerous grant recipients have contacted Nature Trail about their particular circumstances concerning their poor experiences trying to deal with Service NSW Business Bureau debt collectors.

They have just recently sent us a copies of now invoices received relating top the full grant value received from Service NSW, typically $15214!

Here are five currently live and pending invoices, which separate grant recipients have sent to us for review. For privacy respect in publishing these we have redacted (hidden) all identifying details on each of these invoices – no less than 9 identifying data fields!

Nature Trail’s Tour Director, happens to also be an experienced Business Analyst of over 20 years in corporate and government senior roles, so he has some understanding of commercial matters. In this case, we ask readers to consider the shown information on these invoices. What do you notice?

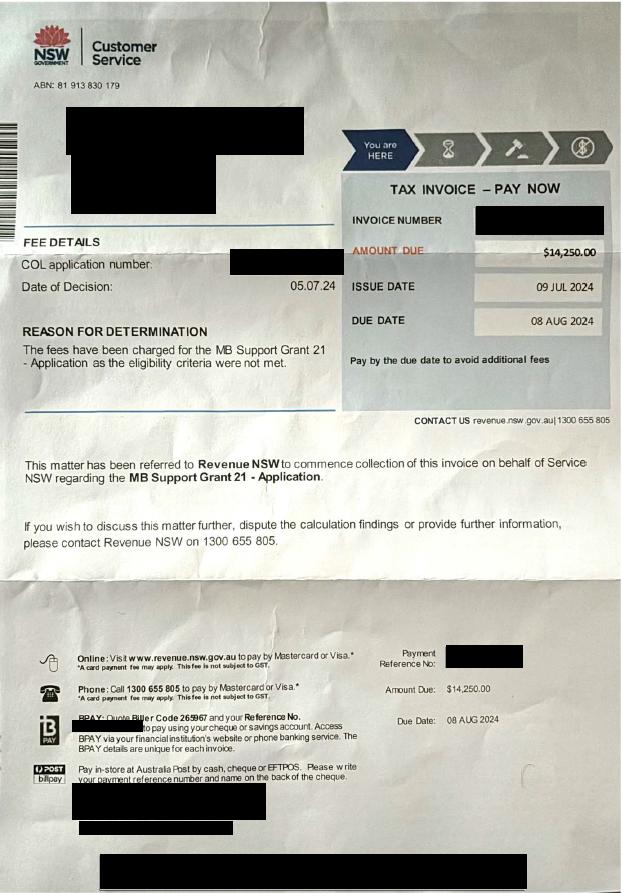

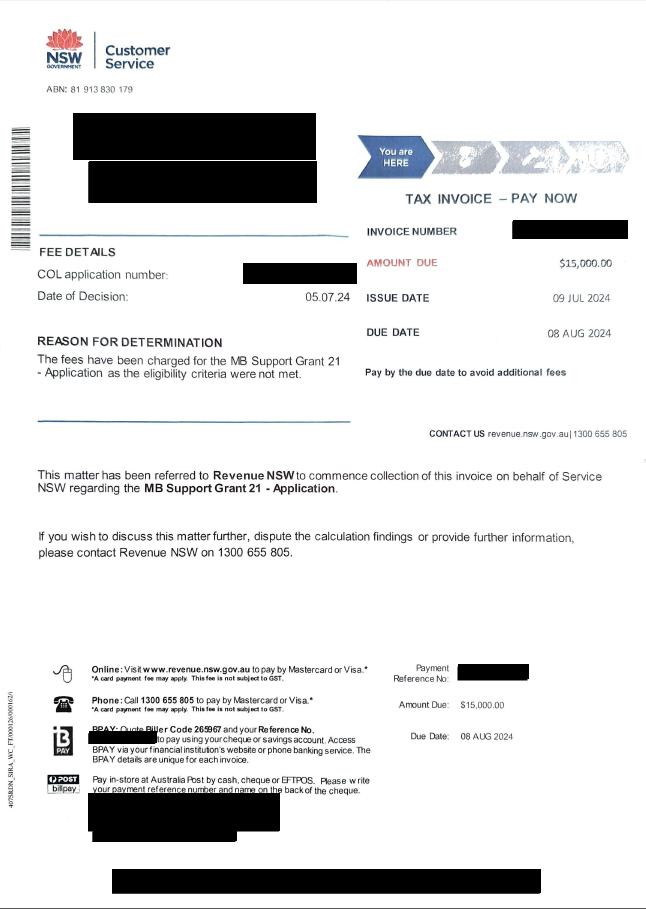

Debt Collection Invoice #1:

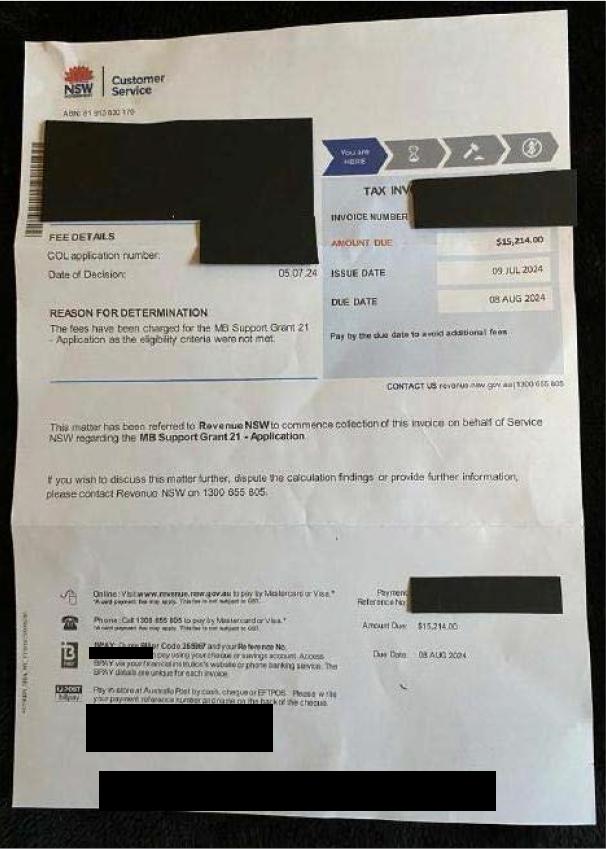

Debt Collection Invoice #2:

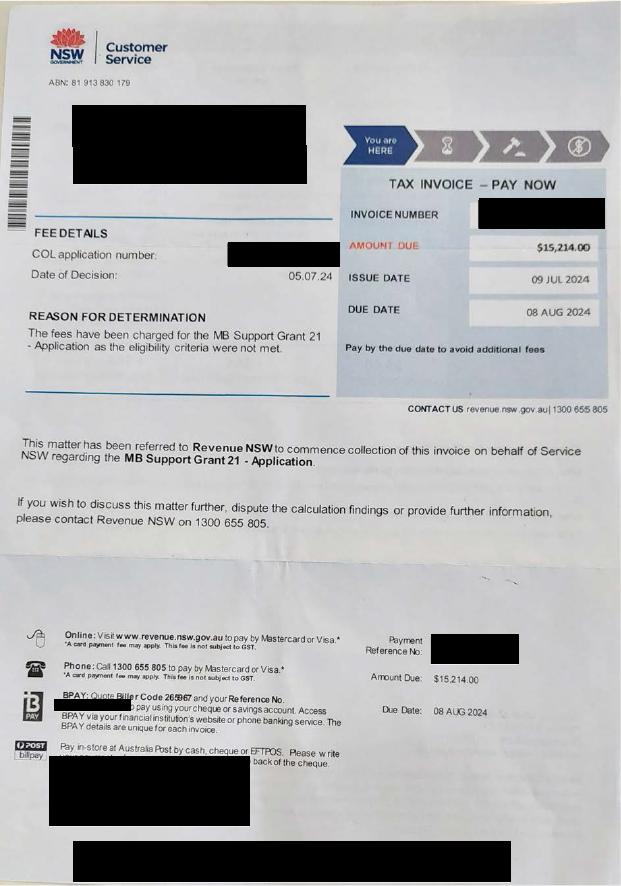

Debt Collection Invoice #3:

Debt Collection Invoice #4:

Service NSW outsourced invoicing of its grant is churning out roneoed mass invoicing to supplant its claw back so-called ‘audit’ scam.

Compare these two NSW Minns Government department head offices by spotting a recent similarity below…

Spot the difference. Same address, same floor, but down the corridor there is a different office?

The Minns NSW Labor Government minister responsible for both departments on the same floor is Jihad Dib, MP

A critical analysis of such invoices:

We have noticed a number of concerning aspects to these invoices, for all grant recipients to be mindful of, notably (from top to bottom):

(A) These non ‘Service NSW’ invoices are invalid:

These invoices are not from Service NSW [ABN 37 552 837 401]. Instead they are on a letterhead of a different unrelated NSW Government agency, its Department of Customer Service [ABN 81 913 830 179], with which none of the grant recipients had/has any contractual arrangement.

Consequently, such invoices from a non-party to the grant contract (the Department of Customer Service) addressed and sent to each party to the grant contract (the grant recipients) are legally invalid for this reason alone.

Loading...

Loading...

(B) Tax invoice number?

The Department of Customer Service tax invoice number is that of Service NSW grant application number. The accounting system invoicing of Service NSW is not involved, which indicated that Service NSW accounting system is not set up for such invoicing.

This indicates that Service NSW administration system for its grant assessment, approvals and refund invoicing either does not exist or is in a shambles internally – hence perhaps why Service NSW resorted to its contrived so-called ‘audit’ because it had lost the application records and supporting documentation of many/or even all of its grant recipients.

Conversely, the Department of Customer Service accounting system, by using the grant application numbers of Service NSW for its invoice tracking, likely has a hybrid invoicing system outside its main invoicing system, which certainly would have a different numbered series for its invoice generation.

(C) ‘FEE DETAILS – COL application number’ ?

The current Minns Labor Government’s Department of Customer Service in this situation is not including this ‘fee’ as one of its own. Rather it is relying upon a cross-reference to Service NSW department’s COL-xxxxxxx application number, being Service NSW grant application reference number for each of its grant recipients.

For instance, Nature Trail’s reference number was: ‘COL-8718f31-MBS‘.

[Author’s note: Service NSW finally on 30 April 2024 after 12 months of harassment, officially permanently absolved Nature Trail from its grant ‘audit’ and from all liability to refund the grant. We have and retain this correspondence in writing.]

The indicates that Service NSW administration/accounting record database system underpinning its records of its grant process – its assessment, approval, payment, and oddly retrospectively now its claw back invoicing demanding full refund of its grant; well, such an internal dedicated system to monitor this grant either didn’t/doesn’t exist, else it is in shambles.

(D) ‘Date of Decision’ ?

We note that for each of these invoices we have received, the date of decision is the same: 05.07.24. We note the date format of DD.MM.YY.

We observe that this date format is notably different to the Tax Invoice format on the same invoice, being DD-MMM-YYYY.

Mmm, we suspect each records are sourced from different departmental accounting software systems.

Also, co-incidental dates? This is the Friday 5th July, at the end of the same week of the start of financial year 2025 from Monday 1st July.

A new financial year ‘audit’ wind-up ultimatum from on high? A new financial year, a new bureaucratic tactical ‘ramp-up’ shift by Service NSW internally? We’ve received quiet communications from insiders to this effect. Service NSW structure, management and staffing is about to hit the fan.

We note that currently at least, Service NSW CEO Greg Wells in charge overall. Service NSW has resorted to hand-balling all its fabricated (yet still unresolved) grant audit cases over to Revenue NSW – the NSW Government’s ‘big brother’ debt collection machine.

Revenue NSW is situated out west at Parramatta, the NSW Government’s new bureaucratic hub. It’s debt collection machine is tasked to man hunt those it terms own ‘CIVIL DEBT‘.

It is Service NSW’s despicable ‘tar brushing’ treatment of all grant recipients no different to the tiny few criminally caught bad apples who tried to fraud the NSW Government’s lockdown compensation grant – presumed fraudsters, guilty until proven innocent.

This is a baseless, underhand and unconscionable tactic by Service NSW.

It represents an extreme abuse of this NSW Government agency’s authority and power. It is likely to cause considerable financial hardship to many grant recipients who cannot afford to refund the grant and also lead to immense mental anxiety.

This is ‘Robodebt’ Mark 2.0

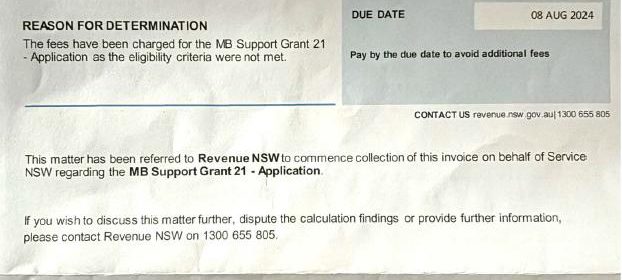

(E) ‘REASON FOR DETERMINATION’ ?

We note that consistently on each of these invoices, which presents as a mere sample of perhaps hundreds or thousands of Service NSW roneoed invoices at the same date to its unsuspecting victims – its legitimate grant recipients.

That same reason for determination:

“The fees have been charged for the MB Support Grant 21 – Application as the eligibility criteria were not met”

How vague a justification?

This baseless accusation of ineligibility is without proof or foundation. Service NSW fund has failed to establish in each grant recipient’s case that its accusation of “eligibility criteria were not met”.

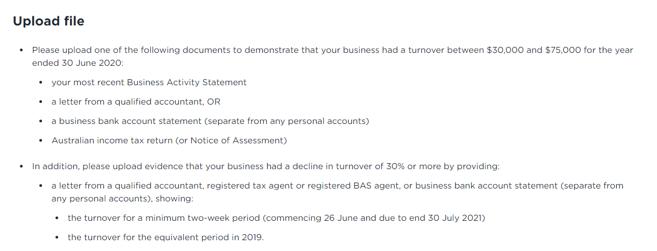

At the time of application, the online form provided for support documentation to be uploaded to the application, as follows:

It was this information that was part of the assessment process by Service NSW before making a decision to approve each grant application. In the case of Nature Trail, which complied with this, following our submission of the application, Service NSW contacted us by phone and email requesting additional supportive information, which was then also supplied. Following this our application was approved ten days after our original submission. This verifies that Service NSW approval process was not “automatic” as was later claimed by the various contracted debt collectors at Service NSW.

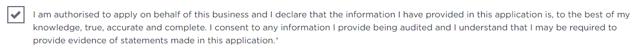

The online grant application form that was on Service NSW website at the end included a Declaration section, which required applicants to ‘check a box’ to compulsorily agree to various undertakings. This included agreeing to “consent to any information I provide being audited…”

Applicants were also mandatorily required to ‘check a box’ to declare that they had read and accepted the Terms and Conditions of the grant. This despite those terms and conditions not being easy to find. There was no link to them on the application form.

In the Terms and Conditions of this grant, relevant Clause 4.7 stated:

“A business or not-for-profit organisation may be audited or investigated by DCS and/or Service NSW to determine whether it is complying with these Terms and Conditions.”

That being said, when over a year after the grant had expired, selected applicants were then contacted by phone and email by anonymous individuals (using only their first name and no other details) and immediately accused of being retrospectively ineligible for the grant, despite having been assessed and approved after application and before grant payments being made. This communication tone and behaviour did not constitute an audit, but rather a harassing scam without foundation.

Service NSW, from both the original applications by grant applicants and from those same grant recipients it has retrospectively targeted for ‘audit’ proof of eligibility for receiving the grant, has failed to substantiate any details of such ineligibility.

Service NSW retrospective request for grant recipients to resubmit the same supporting documentary evidence, also does not constitute and audit, but rather a repeat of the original application information. It is as if Service NSW had failed to duly keep records from the applications, that it had no grant database, and that the contracted debt collectors (mostly working from home it seems) did not cross-communicate with their colleagues about the subsequent information each had received from the applicants. They have not been talking to each other.

Service NSW website currently shows that it received some 82,497 applications and approved 63,009 of them (some 76%). Clearly, the grant promise made by the Berejiklian NSW Liberal coalition government in July 2021 when it was announced, had not administratively staffed Service NSW to handle the volume of applications. That of course was no the fault of the applicants. The debt collectors had no right to retrospectively label bulk of the business applicants as ineligible fraudsters because of the incompetence of Service NSW.

What a shemozzle!

(F) ‘AMOUNT DUE’ ?

We note a consistency with each of these four example invoices issued by Service NSW recently to its targeted grant recipients apparently ‘outstanding’ on its ‘audit’ books to be still ineligible for its grant payments.

In all four invoice cases, the ‘AMOUNT DUE‘ equates to the same as the entire grant payment by Service NSW to the grant recipient.

This is unjustified by Service NSW. It is baseless and so an invalid invoice scam by Service NSW. Both involved departments are complicit in this extortionate financial scam attempt:

- NSW Department of Customer Service

- Revenue NSW

(G) ‘ISSUE DATE’ ?

We note that for each of these invoices we have received, the Issue Date is also exactly the same, being 09.07.24. So this date being just four days again after the (Service NSW) Date of Decision.

This is consistent with a multiple invoice generation (presumed ‘roneoed’ run) at the same time to grant recipients that Service NSW considers to be outstandingly ineligible.

(H) The ‘DUE DATE’ ?

We note that for each of these invoices we have received, the Due Date is the same, being 08 AUG 2024. It is part of the same presumed ‘roneoed’ run.

(I) Invoice enquiry referral to Revenue NSW:

Each of these example invoices templated script reads exactly the same statement (roneoed off)…

“This matter has been referred to Revenue NSW to commence collection of this invoice on behalf of Service NSW regarding the MB Support Grant 21 – Application.”

This justification statement is vague and without explanation. Why has Service NSW not referred this matter? Why has Service NSW not first ‘dealt with’ this matter?

(J) Discussion option only with Revenue NSW:

If you wish to discuss this matter further, dispute the calculation findings or provide further information, please contact Revenue NSW on 1300 655 805.

(K) The Payment Reference No.:

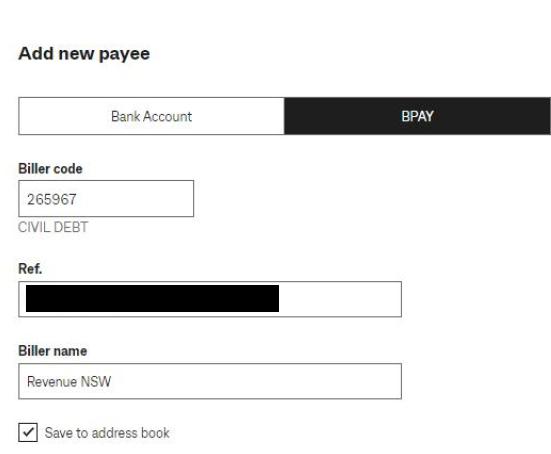

Consistently, on each of these example invoices, the Payment Reference No. is a Revenue NSW debt collection reference. This then repeated on each respective invoice also on the invoice’s BPAY Reference No., and as part of its two barcode printouts.

(L) The BPAY Biller Code – Customer Reference Number:

Consistently, on each of these example invoices, the Payment Reference No. is a Revenue NSW debt collection reference.

Now when one sets up the BPAY Biller Code 265967 in one’s online banking system, that code translates to “CIVIL DEBT” (see below). This is code for Revenue NSW.

Under the NSW Government’s ‘2021 COVID-19 Micro Business Grant‘ (its official title), each grant recipient only had a separate contractual arrangement (commercial agreement) with Service NSW.

“Applications for the 2021 COVID-19 Micro-business Grant opened on 26 July 2021 and will close on 18 October 2021” [Source].

Contractually, each commercial agreement in relation to this grant involved:

- Service NSW on its website, notified NSW businesses of this financial grant compensation in this case, (legally termed ‘an invitation to treat‘);

- NSW businesses then individually applied for the grant on the Service NSW website, having to meet certain stated eligibility criteria with attached evidentiary documentation, as per the published guidelines and Terms and Conditions (legally termed the ‘offer‘);

- Service NSW then assessed each offer (‘application’) and either ultimately accepted (legally termed ‘acceptance‘);

- Service NSW then paid out the grant in numerous instalments (legally termed ‘consideration‘), which Service NSW paid out to each approved applicant business throughout the remainder of calendar year 2021;

That then was the natural legal end to the contractual agreement between all parties to the NSW Government’s ‘2021 COVID-19 Micro Business Grant‘.

[Author: as previous stated, we shall analyse this ‘audit’ in a separate article].

The incompetence of Service NSW in all this contrived ‘audit’ scam is palpable. Service NSW would know how to run a chook raffle or a bath.

OUR BEST ADVICE*….?

DO NOT PAY SERVICE NSW SCAMMERS ANYTHING!

THEY DESERVE NOTHING BUT THE SACK & PUBLIC CONDEMNATION.

References:

[1] ‘2021 COVID-19 Micro-business Grant – businesses can now apply‘, 27 July 2021, by Tim Lyford and Blake Scheffers, William Buck (accountancy and business advisory firm), https://williambuck.com/news/business/general/2021-covid-19-micro-business-grant-businesses-can-now-apply/, accessed 24 July 2024.

[2] ‘BPAY Frequently Asked Questions‘ (FAQ), https://www.bpay.com.au/personal-faqs/

[3] ‘Closed programs – statistics‘, Service NSW website, Closed Service NSW emergency financial programs for individuals and businesses, https://www.service.nsw.gov.au/performance-dashboard/closed-programs-statistics

[4] ‘Audits‘ as defined by the Australia Taxation Office, online document webpage reference QC44841, https://www.ato.gov.au/businesses-and-organisations/corporate-tax-measures-and-assurance/privately-owned-and-wealthy-groups/what-you-should-know/tailored-engagement/audits

[5] ‘ABN Lookup‘, Australian Business Register, Australian Government official website, ^https://abr.business.gov.au/ (Search by ABN or entity name)