Grant original ‘Alternative Rules’ hidden and denied by Service NSW scurrilous anonymous debt collecting scammers

Service NSW under the Minns Ministry must be the most immoral and corrupted public authority operating in New South Wales, if not throughout Australia.

As part of its out of control Robodebt Mark 2.0 Grant Clawback Extortion, it persists in hounding thousands of honest ‘mum and dad’ small business owners who legitimately applied for the ‘2021 COVID-19 Micro Business Grant’ as offered by the NSW Government at the time.

But for some still unknown bureaucratic reason, Service NSW and its ring-ins are trying to now retrospectively clawback all the grant monies paid out using unconscionable tactics and dodgy AI against the honest ‘mum and dad’ small business owners as if extortion targets, such as:

- Changing the Grants Terms and Conditions retrospectively, multiple times to suit is illegal desperate money grab

- Rejecting actual income turnover by businesses that included Jobkeeper Income as mandatorily reported to the Tax Office, despite no such exclusion clause being in the Terms – they just make up a rejection excuse on the fly!

- Hiding Terms original ‘Attachment C’ – ‘Alternative Rules’

Dodgy Service NSW has since the ‘2021 COVID-19 Micro Business Grant was paid out to 63,009 approved grant recipients in 2021, unconscionably removed key elements of both its Grant Guidelines and Grant Terms and Conditions.

Here are the key sections that provide flexible rules for those businesses that didn’t meet all the standard eligibility criteria at the time of application. Many will remember these alternative rules but may have not kept a copy a the time. But at Nature Trail, our Tour Director is an accountant and keeps records, every single one!

So, for the benefit of those many grant recipients still being scandalously targeted by the anonymous debt collection ‘first namers’ to pay back some fabricated debt, we reproduce those missing terms below.

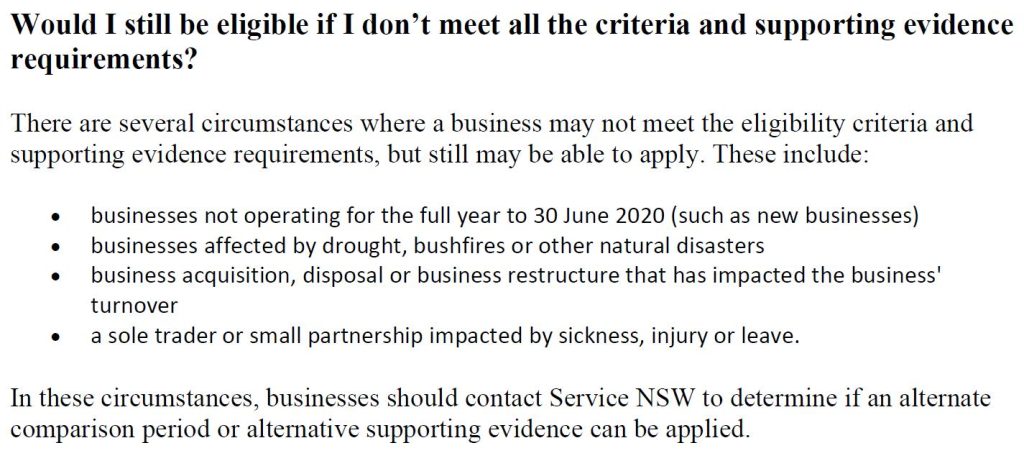

Original Grant Guidelines now missing:

“Would I still be eligible if I don’t meet all the criteria and supporting evidence requirements?

There are several circumstances where a business may not meet the eligibility criteria and supporting evidence requirements, but still may be able to apply. These include:

- businesses not operating for the full year to 30 June 2020 (such as new businesses)

- businesses affected by drought, bushfires or other natural disasters

- business acquisition, disposal or business restructure that has impacted the business’ turnover

- a sole trader or small partnership impacted by sickness, injury or leave.

In these circumstances, businesses should contact Service NSW to determine if an alternate comparison period or alternative supporting evidence can be applied.”

Actual Extract:

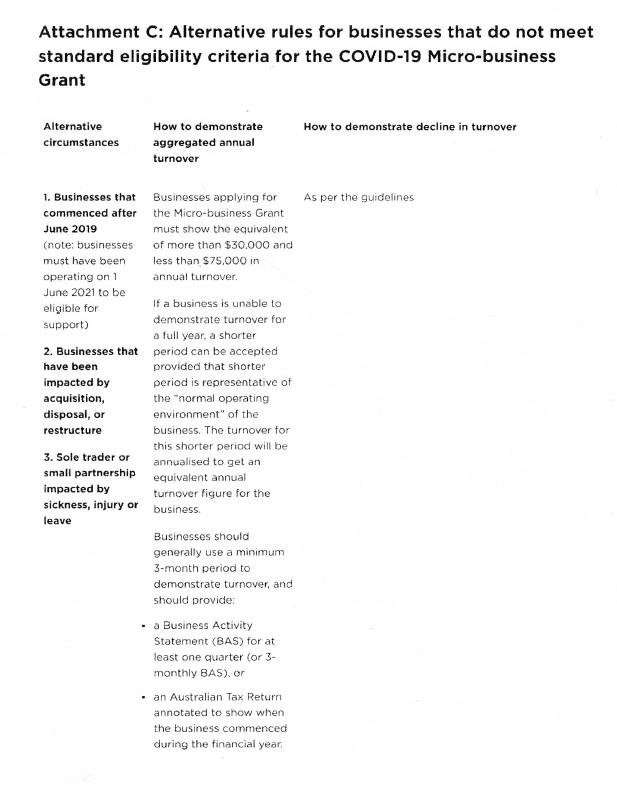

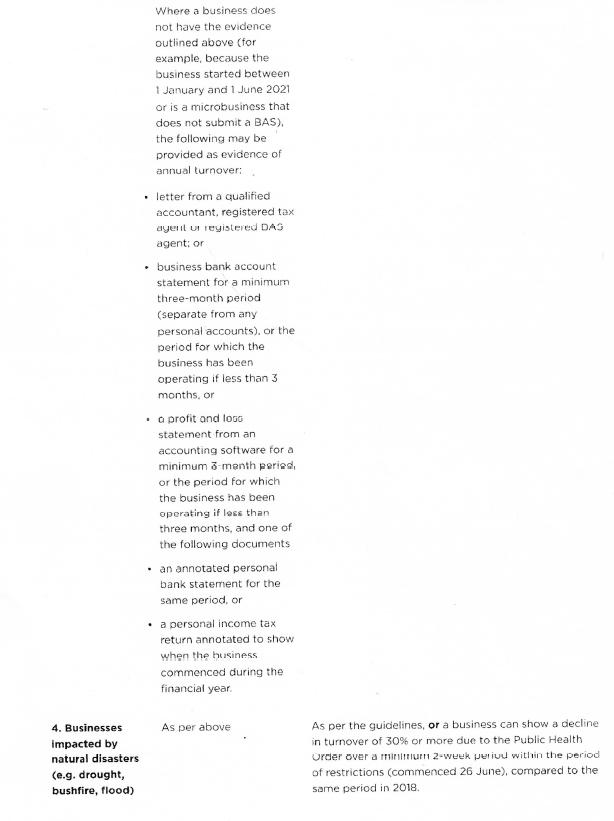

Original Grant Terms and Conditions ‘Attachment C’ now also missing:

Here they are reproduced. Read them! They reveal far more compassionate flexibility during a time of unprecedented governmental imposed lockdown which had shutdown businesses right to trade and earn a crust.

Download this original Attachment A of this Grant’s Terms and Conditions of 2021:

Loading...

Loading...

So, many applicants who for instance were new businesses at the time did in fact contact Service NSW at the time of their original grant applicant back in 2021.

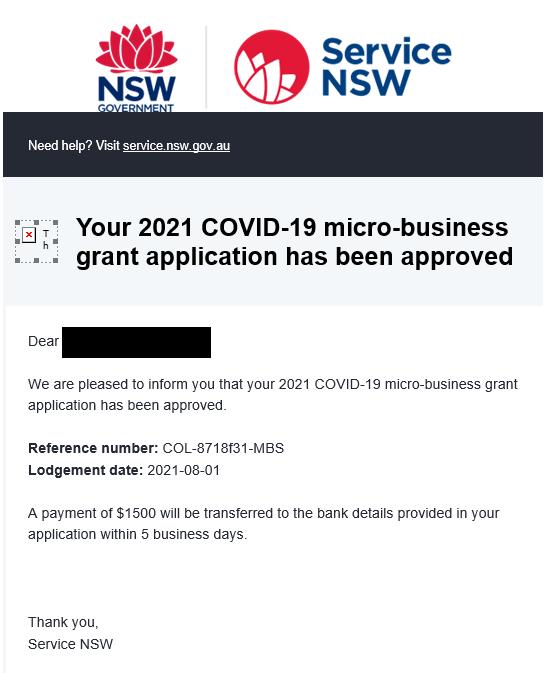

Result? Service NSW sent them an email confirming that they were indeed eligible to receive the grant. Nature Trail was one such new start up business and we checked with the Alternative Rules and Service NSW then checked and came back to us thus:

As for NSW Premier Chris Minns in charge of his Ministry, he feigns a deer in the headlights look, doing an Albo – “Nothing to see here lads!”