Australia Tax Office bullies using “AI” for illegitimate and fabricated debt collection

Anyone out there with a HECS debt, well be wary that the Australian Tax Office (ATO) is on an ‘AI’-induced debt collection war path!

“AI” (so called “Artificial Intelligence”, but from our experience, a more appropriate interpretation of this latest governmental fad ought to mean ‘Automated Incompetence‘.

The use and abuse of ‘AI’ by governments in Australia to do their core duties has become kneejerk uptake and conveniently prolific. It’s a bureaucratic cop out to replace qualified staff who are supposed to know what their doing.

And it’s the innocent law abiding members of the public who are copping governmental targeted fabricated debt collection.

Has this become the true underlying definition of trendy ‘government cost recovery‘ by the bureaucratic bubble mindset in their insular ivory towers? Government bureaucrats couldn’t run a bath.

Recall the Australian Government’s Centrelink’s Robodebt Scheme of 2016? It was all an AI experiment using outsourced automated programmed income averaging that became a monumental stuff up. The Robodebt class action bought by Gordon Legal cost to the Australian Government $1.2 billion, comprised refunds of $721 million to 373,000 vulnerable people reliant upon benefits, $112 million in compensation paid out to the lawyers and $398 million in cancelled debts. It is the biggest class action in Australian legal history.

The ‘AI’ fad is ‘fairies at the bottom of the garden’ stuff!

In our case in 2023, Nature Trail’s Tour Director, Steven Ridd, on top of suffering imposed business trading lockdown from the NSW Government since 2019 (from back to back lockdowns from NSW bushfire emergencies, multiple landslip access closures, catstrophic quarrantine failures that created the Chinavirus pandemic lockdown, then the grant compensation repayment extortion, then the NSW Transport Department’s threat of a $110,000 fine toward Nature Trail for it’s complementary tour vehicle shown on this website.

So, well at age 59, Steven inquired into his own personal superannuation fund provider about the possibility of him withdrawing the balance as a lump sum payout, given that at that age he had legally reached superannuation ‘preservation age’. This so entitled Steven at age 59 to withdraw his superannuation (to pay off his mortgage) without incurring any additional tax penalty. Tax had already been paid on his employer-paid superannuation during his employment career lifetime at the many times of contribution.

Some Background..

So Steven, also an accountant, then in 2023 did his own prior research into the tax laws at the time just as a risk precaution – so…’to be sure, to be sure’.

He went initially to the Australian Taxation Office’s website and learned that the tax law term ‘Superannuation Lump Sum‘ (SLS) was not included in any legal searchable definition of the ATO’s term ‘Taxable Income‘. This definition he also checked on two sets of relevant and current tax laws as follows:

- Income Tax Assessment Act 1997 No.38 (ITAA) of some 5717 pages, no less)

- Higher Education Support Act 2003 No. 149 (HESA) of some 624 pages, no less)

These two taxation Acts are relevant in Steven’s particular case because Steven in 2023 was on the one hand then, an employee of the company that runs Nature Trail, so subject to the ITAA.

Steven also subject to the HESA, because as part of Steven’s qualifications as a Tour Director of Nature Trail, he had in years prior undertaken specific tertiary training in and completing the following TAFE courses:

- Certificate IV in Tour Guiding (2013)

- Certificate III in Outdoor Recreation (2014)

- Diploma in Outdoor Recreation (2016)

Also previously, Steven had commenced a Masters in Project Management at the University of Sydney (UoS) in 2011. This course had been chosen by Steven at the time to enhance his qualifications in IT project management, which has been and continues to be another unrelated part of his commercial career background.

However Steven, after commencing the Masters course at UoS and then being instructed by the university’s course management that as one of just two native English speakers on the course amongst a large enrolled cohort of about 400 premium pre-paid students from overseas who spoke little English and that Steven was required to lead many of them through the course, Steven resigned from that Masters course frankly in disgust.

For Steven, these four courses were each funded by the Australian Government’s then Higher Education Contribution Scheme (HECS). Note that HECS has since been renamed cynically by subsequent governments as ‘HELP’ = Higher Education Loan Programme’, then again as ‘HEL’ =Higher Education Loan, and currently as ‘FEE-HELP’.

However, readers after reading this article may appreciate Steven holding a view that the scheme ought to be renamed ‘HELL’.

So, Steven has an outstanding HECS debt for the Australian Government’s funding of the above mentioned tertiary courses currently totalling $14,120.78.

Hey, under PM Gough Whitlam in the early 1970s, tertiary education of Australians was encouraged and so government funded, instead of taxpayers’ wealth being wasted in ridiculous political pursuits like half a billion on Albo’s Aboriginal Voice scam.

Now, when it comes to understanding tax, Steven didn’t come down in the last rain shower. He’s an accountant and has been properly preparing and lodging both his own individual and company trust tax returns himself for over a decade, since he sacked previous useless tax agents who failed to correctly add up and interpret tax laws.

These days, the government’s HECS rules state that such a HECS debt is not payable until a student can afford to repay the loan. In Financial Year 2023, if one earned up to a gross Repayment Income threshold of $48361, none of the debt was repayable for that year.

Australian tax law is convoluted, so bear with us on this…

The key test here is the tax definition of ‘Repayment Income’, which is defined in tax law under the Tax Office’s Higher Education Support Act 2003 No. 149 (HESA) Section 154-5 ‘Repayment income‘ (a) quote: “A person’s *taxable income for the income year”. This definition cross references to the Income Tax Assessment Act 1997 No.38 Section 4-15 “Taxable Income = Assessable Income – Deductions”. In turn, Assessable Income is defined in the Income Tax Act Section 6.5 as Ordinary Income and Statutory Income.

Yet, Steven’s receipt of his Superannuation Lump Sum (SLS) payment of $59771 in FY2023 at preservation age 59 is NOT included in the definition of either Ordinary Income nor Statutory Income.

Thus, SLS is not taxable Income and so no HECS payable. Q.E.D.!

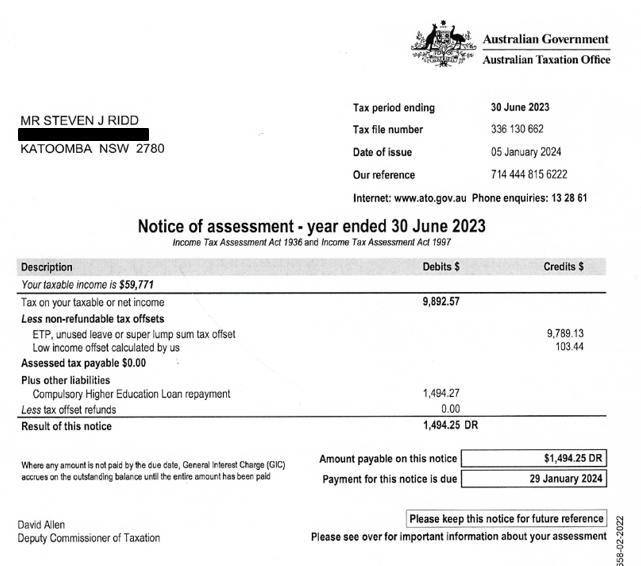

Yet the ATO got it wrong in its tax assessment of Steven’s Individual Tax Return for FY2023, by its incorrect inclusion of this SLS as Taxable Income as shown below.

We note that using AI, the tax office’s Deputy Commissioner of Taxation David Allen (sort of) signed off this assessment notice. In the old days this sort of notice was termed a “Roneo copy” using a Roneo machine. These days it’s “AI” – same but different.

An update in this ‘Paul Hogan style’ saga with the ATO:

So, having had the Chris Minns Mafia’s Service NSW also in anus horribilis FY2023 attempted to illegally extort grant compensation money for the pandemic lockdowns the prior NSW Government had offered and paid to Nature Trail through 2021 (a total of $15,214).

Steven fighting back, beat the bastards. Yet again, now currently has the Australian Tax Office bastards trying it on the extortion. And the bastards are also using “AI” (so called “Artificial Intelligence”).

He says the ATO is using this underhand method:

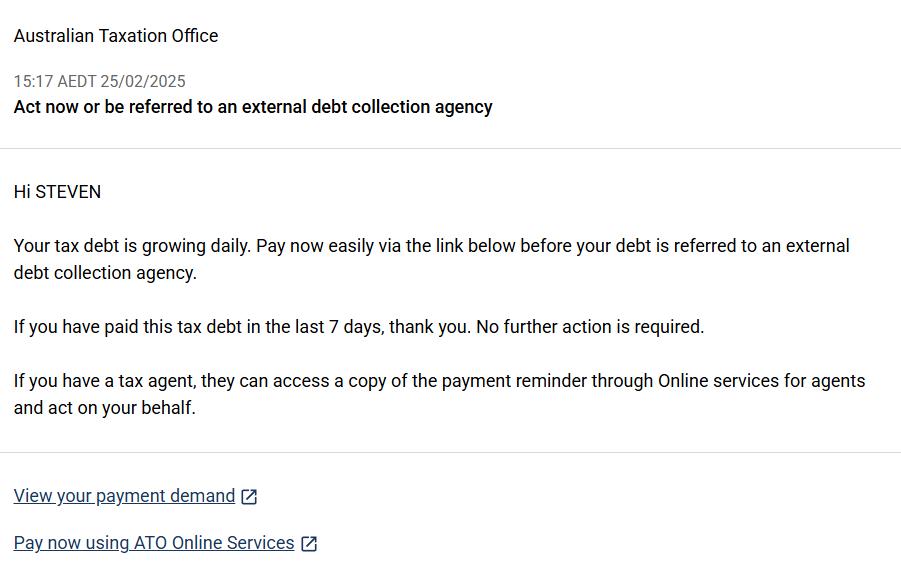

(1) Their AI emails me to tell me I have an email in myGov – yes, a stupid system!

(2) So I then have to log into myGov to read its email (you know I can always close the myGov account and plead that I am just getting too old to use AI (that decision is pending)

(3) So I read the message in my myGov inbox:

“Australian Taxation Office

(4) Well that is nice and friendly, not

(5) But wait, there’s more …

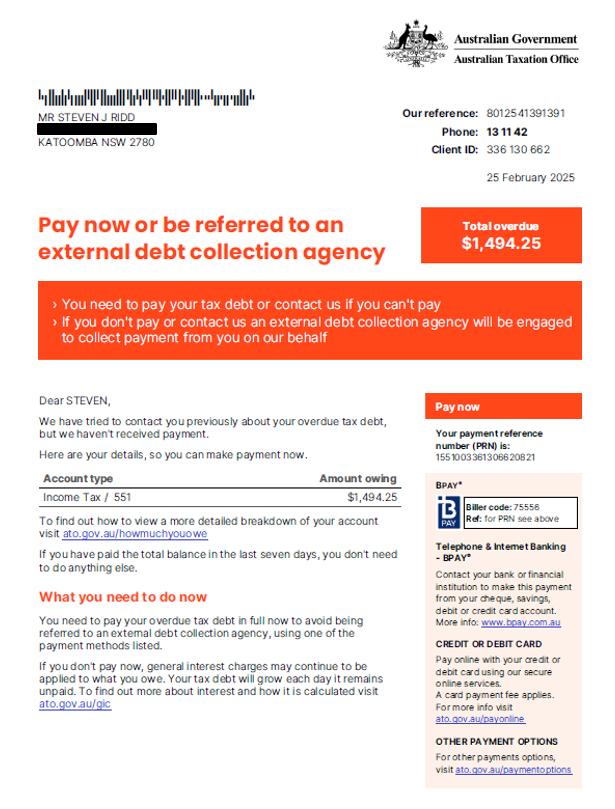

(6) When I click on “View your payment demand”, I get this extortion letter in bright red!

Unbelievable! Tax Office AI fairies at work here.

And this is all the while I have maintained written correspondence with the Commissioner of Taxation about a fee that I have clearly proven to be not payable under tax law.

ATO Tax Commissioner Rob Heferen – Paul Hogan’s nemesis, or was it “boofhead” Chris Jordan, his predecessor?

Superannuation Lump Sums are not Taxable Income!