Service NSW COVID-19 Micro Business Grant – CEO Greg Wells an immoral ‘indian-giver’

Service NSW remains unconscionably hell-bent on federal Centrelink’s notorious 2016 Robodebt method of clawing back its 2021 ‘COVID Lockdown Micro Business Grant‘ funding – two years hence in mid-2023.

We suspect there’s some internal guilt factor going on within Service NSW management.

During the coronavirus pandemic (2020-2022) unleashed from China on the world in late 2019, the previous New South Wales (NSW) state Liberal-National Party (LNP) government under Liberal Premier Gladys Berejiklian recognised that thousands of businesses across NSW (small and micro) were suffering severe financial hardship by directly adversely impacted by governmental-imposed lockdowns.

Government obviously felt genuine guilt for its own publicised failings in quarantine and subsequent lockdowns directly causing severe hardship upon thousands of businesses denied customers, and with nowhere to turn.

Blanket lockdown = no customers allowed = expense overheads unpayable = slippery slope business doom

The outbreak of the COVID-19 Delta variant became rampant from mid-2021 and at thge time showed no signs of easing.

On 26 June 2021, the NSW Berejiklian LNP Government enacted and issued its Public Health (COVID-19 Temporary Movement and Gathering Restrictions). This and other subsequent orders have restricted freedom of movement, gatherings and the ability of many businesses to operate in New South Wales. On 17th August 2021, Premier Berejiklian announced various financial compensation grants for such affected businesses around NSW.

The NSW Government’s compensation included its Micro Business Grant, relevant to our business, which totalled around $15000 to each micro business impacted and meeting the Berejiklian government’s eligibility guidelines. Service NSW was delegated to deliver this grant on behalf of the NSW Government. [READ MORE].

Service NSW did NOT do a very good job. Read on.

This government compensation was a financial and frankly absolute lifeline to thousands off impacted small businesses trying to survive at the time across new South Wales. Most only still are around because of this compensation and maintain the hope of taping into economic recovery, still yet to transpire.

However two years hence, politics happened and the subsequent NSW Perrottet LNP Government was voted out of office in the 25th March 2023 state election.

It was supplanted by an incoming NSW Chris Minns Labor Government to govern New South Wales (below).

Within just a month of the NSW state election result, the same eligible businesses that had received the Micro Business Grant suddenly became quickly targeted by Service NSW to unbelievably expected to repay the grant?

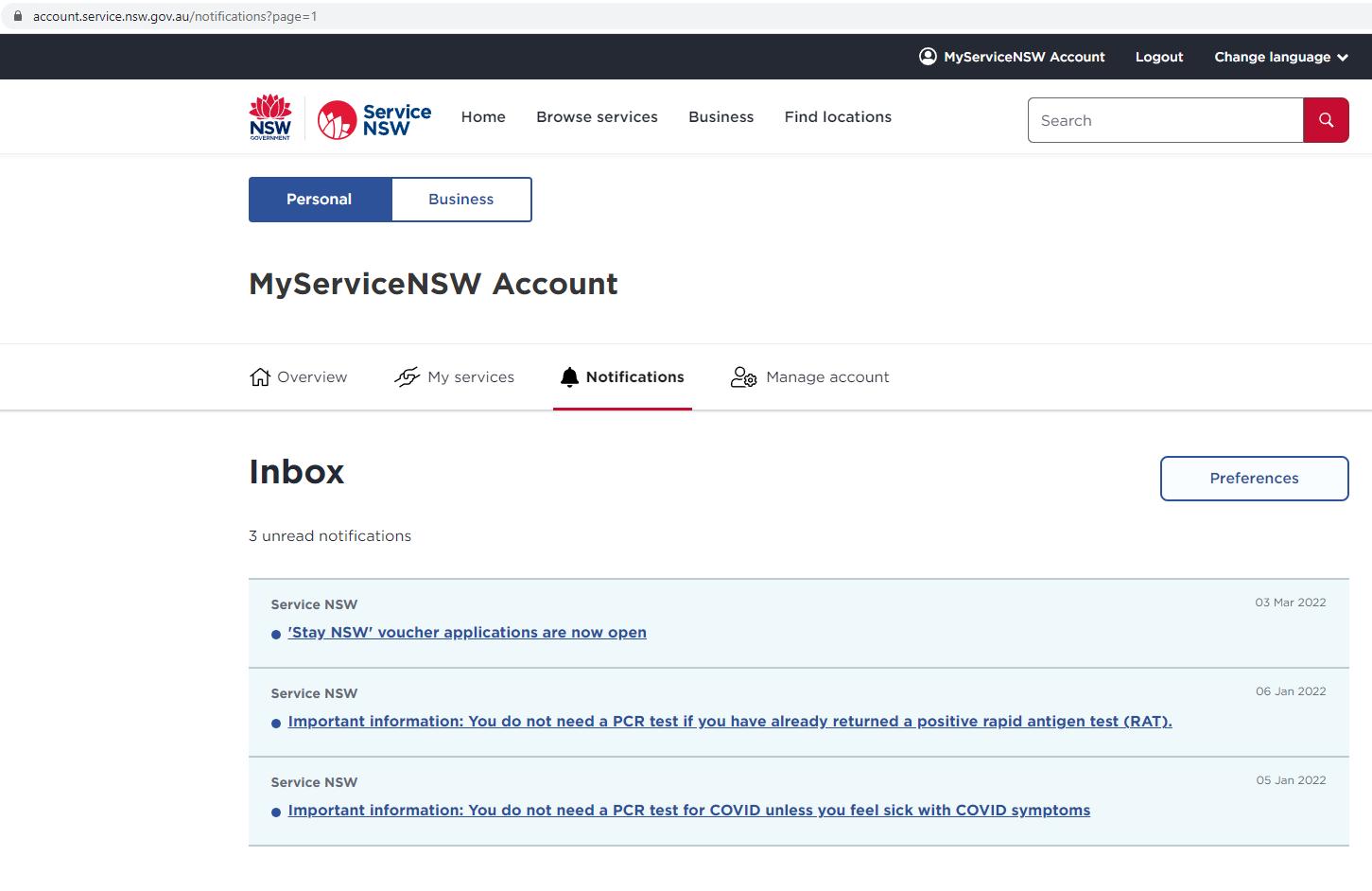

It was not a loan. It was a GRANT, approved by Service NSW’s processes at the time.

Service NSW is the very same mob that had approved and paid out the grant compensation!

Retrospective or what?

Currently at the time of writing two years later well after its payout of the grant, Service NSW is seeking to claw back the approved and paid grant compensation funding from the thousand of small businesses that received it?

Service NSW is supposed to service New South Wales citizens, not become a debt collector for non-debt. Different regime, different new rules it seems? This is an illegal attempt at retrospective grant compensation; otherwise in the US historically termed ‘indian-giving‘ (no racial slur intended).

And who is the head honcho that Service NSW is threatening to escalate its blanket fraud accusations to?

This new bloke, who happens to be a different Indian by ancestry (again, no racial slur intended):

Incoming NSW Labor Treasurer, Nitin Mookhey (Australian-born in Sydney in 1982) – NSW Government’s debt collecting head honcho

Is this a change of government with a change of mindset – trying to clawing back a legitimate and approved compensatory grant for those suffering legitimate financial hardship under pandemic lockdowns?

We believe so.

This grant claw-back tactic seems to be nothing but an underhand bullying attempt by the incoming NSW Labor Party to cash-grab from vulnerable businesses (that can’t afford it because the compensation funding went to pay overheads to survive) in order to fund the NSW Chris Minns Labor Government which suddenly discovered Treasury NSW is cash-strapped.

Our Blue Mountains local tour operation, Nature Trail, at the time was, since 2019 and remains, a fledgling new tour operating business trading in the Blue Mountains. It was denied trade directly since 12th November 2019 by NSW government’s rolling bushfire emergency lockdown regimes, compounded by the floods and pandemic lockdowns.

Out of the blue, Blue Mountains businesses copped the disastrous multi-apocalypse that in 2023 still lingers.

In October 2022, to get some relief during the depth of border lockdown, Nature Trail took off on a needed holiday to Broken Hill and back – all wholly and legally within NSW.

We were pre-warned of military border lockdown to Victoria over the Murray – dared had we turned left at the rural roundabout at Buronga across the Murray into Mildura, we’d have been arrested by pandemic border control and prevented from returning back over the Murray to New South Wales.

NSW refugees in Victoria – Brave New World stuff.

At the time (2020-2022), the NSW Government’s imposed rolling totalitarian lockdown regimes and monitoring with uncompromising enforcement by NSW Police was severe and totalitarian with fines massive of bankrupting scale.

Nature Trail’s tour business was 100% financially impacted by the governmental lockdown regime. We could not legally tour, trade or receive any customers during this rolling lockdown period.

Nature Trail was duly assessed as ‘Eligible’

A case in point – on 1st August 2021, our Katoomba-based tour business, Nature Trail, applied online to Service NSW for this offered Micro Business Grant, supplying factual supporting records in line with the stated guidelines as a fledgling new business, duly as requested by Service NSW.

At the time, our director being an experienced accountant sensibly with a learned for keeping records, all online lodgement details that were submitted, were copied page-by-page for our records….just in case.

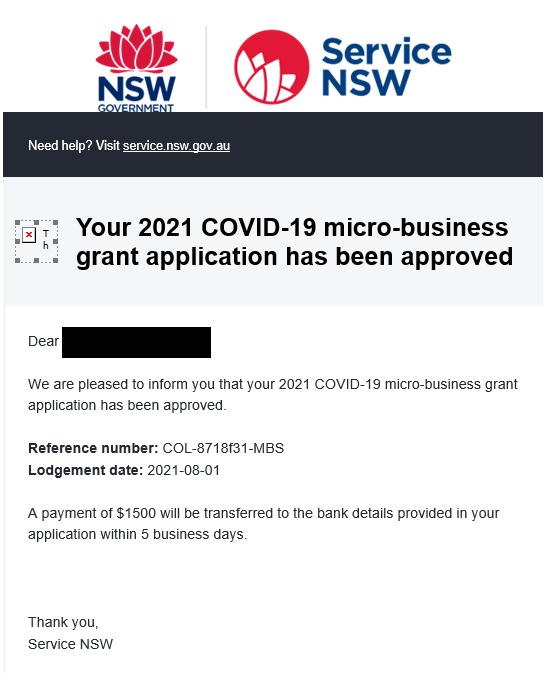

We were then duly assessed by Service NSW over a subsequent ten-day eligibility period . On 11th August 2021, Service NSW emailed is to advice that it had deemed Nature Trail to be successfully eligible to receive this financial grant compensation, confirming this to us in writing, thus:

Nature Trail subsequently received the valuable compensation funding from the NSW Government over the following five months (August 2021 – December 2021) totalling $15,214.

End of story, and we are thankful for Gladys’s lockdown compo, but not the ‘Hazzardous’ lockdowns BTW.

This lockdown compensation was provided by the NSW Government to micro businesses severely impacted by the governmental lockdowns. It had been critical compensation for our business operation at a time of being denied any customers due to government lockdowns. We had been unable to generate any business turnover.

The gifted compensation funding went all back into our business to pay down unavoidable overhead costs, business debts and bills and to keep the business afloat during a time of imposed socio-economic lockdown – as in zero customers and so receiving zero revenue.

A business going concern, even without customer revenue, cannot suddenly stop paying the administrative and overhead costs that enable to the business to legally exist, such as business name registration with ASIC, domain and website hosting, certifications and qualifications re-registrations, accounting software subscription, administration overheads such as phone line account, Internet connection, etc.

Else the business becomes defunct and the business entrepreneur forced by government to write-off years of tens of thousands in the business’s investment, and decide whether to start again all over from scratch.

Few ever do. But then public servants on a voter/taxpayer funded fortnightly stipend, forget electoral promises once the entitlements of office adorn with frankincense and myrrh.

Our Blue Mountains tour operation was hardly unique as an impacted micro business at the time, and in fact remains so like many, well after the NSW Government’s official lifting of mandatory mask wearing and lockdown restrictions public declared from 30th April 2022. [^SOURCE].

Most Blue Mountains businesses were, and continue to be, adversely impacted from the NSW Government failure to control the Gospers Mountain Megafire 2019 along with compounding others across the region and state of NSW at the time, once states of emergency were declared from December 2019.

Regrettably, many Blue Mountains businesses have gone to the wall.

Hey pollies in your insular financial bubble, return to pre-pandemic tour operating trade from overseas visitor demand (our core client base) does not instantly bounce back by magic to translate to constant weekly revenue. Such profitable demand remains dead as at the time of writing this blog article in May 2023.

Service NSW Changes Terms and Stops Paying Out Grant

Back in September 2021, about two months into the fortnightly grant payments, Services NSW suddenly changed its payment terms. It added a mandatory new condition to its compensation payment terms, mandating recipient businesses of the grant to reconfirm grant eligibility status online fortnightly each time in order to continue to received each instalment.

We duly did so. Our business circumstances had not changed (as in still no revenue, and no changes to our micro staffing levels being ‘one’). We had nothing to hide.

Yet for Services NSW to change its own terms and conditions was clearly a breach of its contractual undertaking at the time of approving our application for the grant.

One simply can’t change contractual terms and conditions mid-contract by convenience without prior notice to, and approval by, all parties to the contract. Such introduced terms are thus contractually null and void.

Media news at the time also was reporting stories of many other approved and eligible businesses suddenly denied payment without any warning or explanation by Services NSW.

Something wrong was clearly up within Service NSW management at this time.

Then Service NSW, 2 years later becomes ‘indian-giver’

Nearly two years hence, out of the blue last month on 11th April 2023, we received a cold call to our mobile phone by someone claiming her name was ‘Angela‘ from Services NSW, demanding we somehow refund the government’s $15,214 grant compensation in full ASAP.

Angela insisted in the phone call that we had to first identify ourselves to her – as in supplying her with our personal details – full name, address, family information, bank details, etc.

No bloody way! This being a typical phone ploy by scammers, we sensible hung up, telling the scammer to get a real job.

Then later that day we received the following Service NSW debt collecting spiel by email from ‘Angela‘:

“I am writing to you about your application for the 2021 COVID-19 Micro-business Grant for NATURE TRAIL Our records show that you received $15,214 under this grant.

We need some information from you.

Based on the information you previously provided, we have determined that you are not eligible for the funding you received under this grant.

The Terms and Conditions or (sic) the 2021 COVID-19 Micro-business Grant require that any payment made as a result of an incorrect, misleading or fraudulent claim or as a result of error will be referred to Revenue NSW for funds recovery.

We understand that having to repay the funds may be unexpected and have outlined some actions you can take below.

If you believe that you are eligible for this grant and you have information and/or documentation to support your eligibility, please supply the following by responding to this email by 26th April 2023 .

Please ensure to redact tax file numbers from documents where applicable.

Evidence that the business has a national aggregated annual turnover of more than $30,000 and less than $75,000.

The tax return you sent in was written on we need the real Tax Return.

Please provide evidence that the business has an aggregated annual turnover of more than $30,000 and less than $75,000 for the year ended 30 June 2020 by providing one of the following documents:

letter from a qualified accountant, registered tax agent or registered BAS agent,

Business Activity Statement (BAS),

Australian tax return (businesses can choose to redact their tax file number)

a profit and loss statement from an accounting software for a minimum three-month period during the 2019-20 financial year, AND:

an annotated personal bank statement for the same minimum three-month period, OR

a 2019-20 personal income tax return.

Evidence of decline in turnover

Please provide evidence that the business experienced a decline in turnover of 30% or more due to the impact of the Public Health Order over a minimum two-week period within the period of restrictions (commenced 26 June 2021), compared to:

the same period in 2019, or

the same period in 2020, or

the two weeks immediately prior to any restrictions of 12–25 June 2021 (inclusive).

Please do this by providing:

a letter from a qualified accountant, registered tax agent or registered BAS agent using the template provided by Service NSW:

or

2 business bank account statements (separate from any personal accounts). One statement must be from the 2021 COVID-19 period of restrictions (commenced 26 June 2021). The other statement must be from one of the periods listed above.

Please highlight or annotate the statements to show the 2-week period used to demonstrate decline in turnover

or

profit and loss statements from an accounting software and 2 annotated personal bank statements. One statement must be from the 2021 COVID-19 period of restrictions (commenced 26 June 2021). The other statement must be from one of the periods listed above.

Our request for supporting evidence is made in accordance with the Terms and Conditions of this grant, to which you agreed when submitting your application.

Please note that it is an offence under the Crimes Act 1900 to make a false declaration when applying for grant funding. Any application deemed fraudulent will be referred to NSW Police for further action.

Next steps

If we do not hear from you, or if you do not provide the requested documentation by 26th April 2023 this matter will be referred to Revenue NSW to begin funds recovery. Revenue NSW will mail you a notice that includes information outlining how to request a payment plan or apply for hardship options if you require additional support.

You can also find information on payment plans and hardship options at https://www.nsw.gov.au/money-and-taxes/fines-and-fees/fees/difficulty-paying-your-fee.

If you believe your business complied with the Terms and Conditions or if there is any additional information you would like to provide to prove your eligibility under the Terms and Conditions, please reply to this email before 26th April 2023

If you need more than 10 business days to respond to this request, please reply to this email to request more time.

Need more information or support?

If you would like to discuss the items outlined in this email, need help understanding what you are required to do or need more time to complete this request, please reply to this email. Alternatively, you can book a call to speak with a grants assessor at https://book.service.nsw.gov.au/services/grants-mbg/landing.

Kind regards

Angela,

Service NSW.

Seriously?

Nature Trail’s 2021 application for the NSW Government’s Micro Business Grant had been assessed and approved by Service NSW in August 2021 as being eligible. No data we submitted was anything other than factual, honest and substantiated.

We had waited ten days for our grant application to be assessed and approved, and whether any extra supporting documentary evidence may be required by the assessing department Service NSW. None was and our application was approved by Service NSW.

Yet now nearly two years later, a new government regime claims we are auto-fraudsters somehow and demanding all the grant money back as if we had no right to it in the first place?

Frankly GFY! Is this blatant, in old language – ‘Indian-giving‘ or what?

SERVICE NSW: “Yeah we paid y’all our guilt pandemic compo. But now modified clause #99999 (terms you ticked) entitles us to robo claim it all back, you default fraudster!”

We critique that Services NSW email above by ‘Angela‘ as making baseless claims and intimidating threats, thus:

- Service NSW presumes our guilt as a grant fraudster (guilty until proven innocent)

- Service NSW is attempting to re-assess eligibility almost 2 years after its own assessment, approval and full payment of the grant

- Service NSW threatens grant recipient like us with police arrest for baseless fraud (we actually rang the NSW Police at the time and they said its sounded like a civil matter, or a criminal matter, and so has nothing to do with police

- Service NSW threatens us with contrived debt recovery (see 3)

- Service NSW intimidates just like Centrelink’s contrived Robodebt computer algorithm based attack on vulnerable pensioners (may be Angela was trained by same)

- Service NSW debt collectors displayed a total ignorance of tax accounting knowledge: “The tax return you sent in was written on we need the real Tax Return” (so what? manual tax returns are legal). What an ignoramus?

- And how’s this: Service NSW: “We understand that having to repay the funds may be unexpected.” (How flippant? The government grant was gifted compensation, not a loan, dudes.)

This is no audit.

It’s purely a witch hunt by a desperate Service NSW that stuffed up on governance big time. It smells very politically motivated in the context.

We call it out for what it is – underhand reneging on contractual obligations Service NSW alone approved.

This so-called ‘audit’ action is nothing but interrogation by Service NSW. It is not an audit, because it presumes guilt and is blanket accusatorial. The action is invalid and an abuse of this department’s delegated authority.

NSW Police initiate ‘Strikeforce Sainsbery’

Back on 9th November 2021, NSW Police’s State Crime Commander Assistant Commissioner Stuart Smith publicly had announced ‘Strikeforce Sainsbery‘ to investigate instances of grant fraud associated specifically with Service NSW grants. Watch the video below.

[NOTE: We sense that the strikeforce naming of ‘Sainsbery’ was deliberately misspelt by NSW Police to distinguish it from the real traditional Sainsbury from the UK so as not to contaminate the legitimate UK retail brand Sainsbury’s.]

Importantly, Nature Trail has NOT been contacted by police because we have not committed any fraud.

We had provided copious factual evidence to Service NSW as requested before, during and then afterwards to Service NSW to prove that. Perhaps Service NSW had failed to keep proper records of our grant application, for it to asks us to supply it with our same evidence again later?

We retain all that evidence and we kept screen captures of every single submitted information on the Service NSW ‘s website application form at the time back on 1st August 2021.

Now the press release by Service NSW (November 2021) came just four months into the NSW Berejiklian Government’s Micro Business Grant offer from July 2021. So it took some time for some senior bureaucrat in Service NSW to wake up to the realisation that its grant application checks and balances and processing had serious loopholes.

By November, Service NSW had referred some 13,000 COVID-19 paid out grant claims to the fraud police.

One enterprising young fraudster Jai Falzon (21) of Nowra wangled $530,000 from the Micro Business Grant by applying for it some 51 times!

So how did this youngster’s excessive grant claims not get detected as suspicious by Service NSW? Apparently the Service NSW assessors didn’t detect any anomalies during the application assessment process because Falzon had simply used different bank accounts to receive the funds.

Clearly this lay tactic fooled Service NSW’s grant application process checks and balances , all wangled by a young 21-year-old!

May be also fraudsters applied from interstate and overseas and even dead people managed to get auto-paid by Service NSW auto-approval process?

Governance at Service NSW clearly does not exist.

Following the 13,000 payout vetting failures by Service NSW, then CEO Damon Rees called in outsourced debt collectors. As the fraud snowballed, in desperation he then called in the cavalry via Gladys – NSW Police’s Financial Crimes Squad.

This departmental otherwise diverting the work of its 50 police investigators and resources.

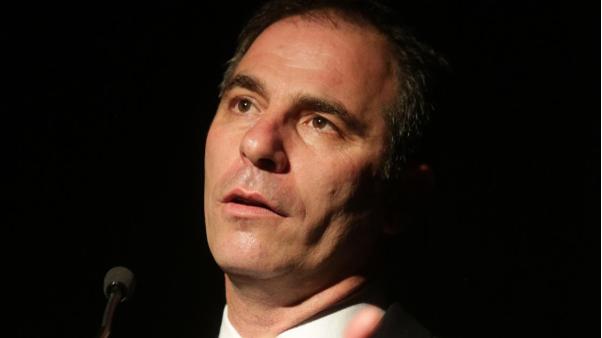

And this was the young bloke heading up Service NSW at the time, Damon Rees:

Qualifications? Experience? …obviously no accountant, or systems expert or risk manager, let alone an auditor [^READ MORE]

It has transpired that Service NSW approved $15.9 million worth of fraudulent Micro Business Grants which it happily paid out between July and September 2021. This equates to 2.6% of all paid applications.

This calculate to a total of $611 million pay outs by Services NSW for Micro Business Grants.

Fraud Police had since prevented a further $4.6 million in suspected fraudulent micro-business grant applications being paid by Service NSW.

So in the video above, NSW Police’s State Crime Commander, Assistant Commissioner Stuart Smith certainly found himself a busy task, no thanks to Service NSW incompetence.

How much did all the outsourced debt collection agency fees and NSW Police budget cost to clean up Service NSW’s extreme financial loss mess from start to finish? That yet to be disclosed cost, needs to have the $15.9 million fraud rort reported transparently in Service NSW’s annual financial reporting.

Service NSW Statement:

“From 20 September businesses were required to reaffirm their eligibility each fortnight to continue to receive the 2021 COVID-19 micro-business grant payments. Service NSW fraud and compliance investigators identified anomalies in some applications made for the 2021 COVID-19 micro-business grant in late October. We were forced to pause the 2021 COVID-19 micro-business grant payments temporarily while the anomalies in some applications were investigated. Recurring payments for existing applicants have now resumed with 7,500 applications processed overnight with the majority of eligible payments expected to restart in the coming week. It is incredibly disappointing that deliberate, coordinated fraudsters have undermined the systems put in place to support the businesses of NSW in one of the most challenging times we have faced. Service NSW is continually strengthening its fraud prevention and detection systems and takes action to report suspected fraudulent activity to the NSW Police and other law enforcement bodies. There are multiple checks and balances in place to ensure applications are properly reviewed and taxpayer funds go to those who meet the eligibility criteria and need it most.”

SOURCE: ‘Service NSW and NSW Police announce Strike Force Sainsbery to investigate grant fraud‘, 9 Nov 2021, released by: NSW Department of Customer Service (service NSW, ^https://www.nsw.gov.au/customer-service/media-releases/service-nsw-and-nsw-police-announce-strike-force-sainsbery-to-investigate-grant-fraud

This fancy new umbrella department, Service NSW, is costing NSW taxpayers more than it is worth, only double-handling government revenue processing on behalf of other departments. Those other departments since going about their public service activities out of the public limelight, uncontactable by the public due to the veil of Service NSW.

Service NSW was conceived by one of NSW less revered short-term NSW premiers, Liberal Barry O’Farrell MP, who served as NSW Premier 2011-2014, during which time Service NSW was established.

Due to the exposed incompetence of Service NSW allowing mass fraud of a legitimate grant compensation, some Nazi-style financial putsch against all grant applicants was subsequently unleashed to outsourced debt collectors to claw back the lost millions.

No applicant is safe – guilty until proven innocent. Look out you vulnerable NSW businesses (small and micro) impacted by the governmental lockdowns during the pandemic. Services NSW now deemed you all fraudsters and are sending in their taskforce to knock down your doors to recover the missing millions, so-claimed.

[Does CEO Greg Wells need to fund his new corporate drive – a red Maserati perhaps?]

This is akin to the Spanish Inquisition of yore, aided and abetted by a Nazi-style collections agency. Is this legal in democratic Australia in 2023?

Neo-Nazis or what? The NSW Government grant funding claw back is wrong and unconscionable. Five days after receiving this vile email be replied lodging a formal complaint directly to Service NSW CEO Greg Wells, which we herein reproduce below.

It seems to be a similar bureaucratic knee-jerk political reaction to sensationalist media frenzy over a few exposed bad apples out there. Cynically, we surmise that pollies have run out of taxpayer funds to sustain their insular financial bubble, and so have got desperate for cash.

Just how bad can government get?

Our Complaint Against Service NSW Ignored

In response to this email of 13th April 2023 we immediately replied to info@service.nsw.gov.au stating:

“Hello Services NSW,

FORMAL COMPLAINT

I have just received this email below.

I consider it to be spam and shall ignore it.

Regards,”

Over the next few days we then received further phone calls purportedly from Service NSW with the same intimidating unfounded accusations of fraud and demanding $15,000 from us.

The callers to us in each case first insisted we identify ourselves and requested our personal information. But they were phoning us, just like scammers do. So we rightly hung up on them in each case.

Annoyed with this appalling treatment, we phoned Service NSW on its call centre number 13 77 88 to verify the legitimacy or not of this out-of-the-blue audit claim by government and to lodge a formal complaint against Service NSW.

We were transferred to supposedly to the ‘Complaints’ department, but the operator ‘Sam’ immediately ignored listening to our complaint and instead proceeded to rattled off the same accusatorial scripted spiel and interrogation questions, challenging our right to have received the grant funding, looking for any clause excuses.

We then received the following email from Services NSW email: <smallbusinessassistance@service.nsw.gov.au>

(We have redacted key details):

“Hello XXXXXXXXX,

Service NSW for Business is committed to supporting business owners as they start, run and grow their businesses, and as they adapt and recover.

You have recently lodged a complaint and as part of our commitment to continuous improvement, we would appreciate your feedback about how we handled your complaint. This feedback will allow us to improve how we manage complaints made to Service NSW for Business.

Please answer the brief questions in the link below – it should take no longer than 3 minutes.

Take the Survey

If you are unable to click the link above, please copy and paste the URL into your internet.

https://nswgov.qualtrics.com/jfe/form/SV_bI2L4MaqCAPFQz4?Q_DL=sALNbyvVXJa3bWx_bI2L4MaqCAPFQz4_CGC_TolstdAt4dViHBp&Q_CHL=emailThank you for your time.

Your case reference number is: XXXXXXXXXX

Please contact us at 13 77 88 and ask to speak with a Business Concierge if you have questions or need support.

Kind regards,

Service NSW for BusinessThis email was sent by Service NSW, Level 19, 2 – 24 Rawson Place Sydney, NSW, 2000. You’ve received this email because you’ve signed up to the Service NSW Business Concierge service.”

It became abundantly clear to us that this ‘Sam‘ and then ‘Nicole‘ and previously ‘Angela‘ were not in fact Service NSW staff, but ring-in contracted trained debt collectors from some private agency that had been outsourced by Service NSW senior management directed by CEO Greg Wells.

Now given that NSW Treasury is situated at 52 Martin Place in Sydney’s CBD, it would be most likely that Service NSW, also in Sydney CBD would outsource the same debt collecting agencies, the likes of CBD-based:

- Dun and Bradstreet

- Debt Recovery Australia

- Austral Payment Management Services

- NCS Debt Collector

- CCSG

- Slater Byrne Recoveries.

Such debt collectors were instructed by Service NSW management that all grant recipients had agreed to be later audited, meaning the debt collectors considered they operated under some contractual right to investigate and interrogate for debt recovery any grant recipient on behalf of Services NSW (aka Big Brother).

Given the intensity of the callers’ interrogation, we presumed each must have been contracted to operate on a commission basis, perhaps with no retainer. One caller ‘Nicole’ contacted us from her private home somewhere near rural Crookwell, north of Goulburn.

Not surprisingly, at the time Service NSW was exposed in a privacy breach scandal in which its website made public the data of 3700 of its customers including drivers licence details, vehicle registration, mobile numbers and names of children. [READ MORE]

This immoral action follows three years of emergency lockdowns imposed by the NSW Government as result of catastrophic widespread bushfires, floods and pandemic across New South Wales and in particular the Blue Mountains Region.

Salt into the wound? How many suicides is Services NSW seeking for its performance metrics?

This national emergency saga dominating New South Wales and Australia 2019 through 2022, is but another legacy of governmental incompetence to deal with national emergencies before during and after the events.

The defence and critical support of ordinary Australians and their businesses and livelihoods were not prioritised by governmental bureaucracy subsisting in an insular financial bubble on the teat of taxpayers, all the while aloof from the pains that entrusted and duty-bound government recklessly allowed to be inflicted and fester upon its citizenry, its most vulnerable, Australia’s natural environment, economy and undermine the national psyche and wealth.

So, is Service NSW in its infinite wisdom (not) under some grossly misguided CEO is now demanding all this compensation funding be refunded, unjustifiably presuming every grant recipient business has been a default fraudster?

Government Gross Mishandling of the Pandemic

We recall that NSW Police and Revenue NSW, the NSW Government’s Treasury pit-bull debt collector, sent in burly cops to fine innocent young people $5000 sun-baking by themselves on beaches without wearing COVID-19 compliant AMD P2 (N95) mask.

But, it got worse…

Isn’t Quarantine the responsibility of our federal government? It’s a bit late when government allows foreign viruses and plagues into Australia. It’s then a bit rich to condemn Australian citizens after the fact.

Service NSW is not learning from ScoMo’s Centrelink’s Robodebt Scandal

Umbrella cluster department Service NSW (New South Wales) must be the most morally bankrupt government department anywhere in Australia.

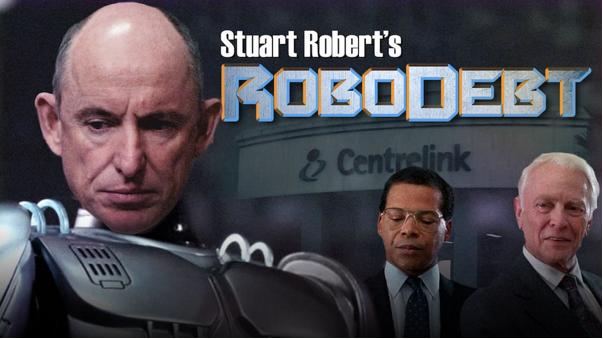

CEO Greg Wells is copy-catting Centrelink’s disgraceful Robodebt scheme from 2016.

Centrelink’s immoral scheme was conjured up from some internal bureaucrat using vague average calculations in some guesswork computer algorithm to indiscriminately target vulnerable poor people like pensioners and the unemployed on measly Centrelink benefits.

As many as 443,000 Centrelink registered recipients were treated by Centrelink as default criminal fraudsters by its outsourced and miscalculated ‘one-size-fits-all’ averaging computer algorithm.

Centrelink’s presumption? Guilty until otherwise proven innocent!

PM Scott Morrison’s federal Liberal Cabinet Minister for Employment, Workforce, Skills, Small and Family Business Stuart Roberts (March 2021 to May 2022) from Queensland’s Gold Coast During this time Roberts was Scomo’s revenue pit-bull driving Centrelink’s unconscionable Robodebt Scheme against Australia’s most vulnerable. 2030 suicides as a result that we know about.

Roberts went after Australia’s impoverished most vulnerable – the unemployed, aged pensioners, homeless youth, those in social housing – all targeted victims of Centrelink big brother welfare monopoly. His tactics were heavy-handed dispatching of intimidating legal threat letters of demand to 5 million registered with Centrelink. Some 443,000 ordinary Australians were targeted to repay Centrelink’s breadline poverty payments or else!

Gordon Legal filed a class action lawsuit for 6 applicants and other group members against the Commonwealth of Australia. It is about Centrelink debts raised under PM ScoMo’s federal Liberal Government Income Compliance Programme dished out by Canberra between July 2015 and November 2019.

The Centrelink Debt Programme was established in July 2016 by Centrelink, within the Department of Human Services (DHS). It commenced using a new Online Compliance Intervention (OCI) system for raising and recovering debts. The use of this automated system has been referred to many as ‘Robodebt’, primarily because the system led to debt recovery letters being automatically generated by a computer programme algorithm (concocted mathematical formula loaded with general assumptions).

In its 2017 inquiry into the OCI system, the Commonwealth Ombudsman described the operation of the automated system as follows:

‘The OCI matches the earnings recorded on a customer’s Centrelink record with historical employer-reported income data from the Australian Taxation Office (ATO). Parts of the debt raising process previously done manually by compliance officers within DHS are now done using this automated process.

Customers are asked to confirm or update their income using the online system. If the customer does not engage with DHS either online or in person, or if there are gaps in the information provided by the customer, the system will fill the gaps with a fortnightly income figure derived from the ATO income data for the relevant employment period (‘averaged’ data).

The deployment of the Centrelink Debt Program, which used this OCI system, resulted in a very large increase in the scale of DHS’s debt-raising and recovery process. Using the manual system of identifying discrepancies, DHS estimated it would make around 20,000 compliance interventions per year; in 2016–17, DHS estimated it would undertake approximately 783,000 interventions.

The subsequent Robodebt Class Action settlement by Gordon Legal against Centrelink from 2019 resulted in the Federal Court of Australia on 11 Feb 2021 ordering Centrelink to wipe its $1.8 billion unlawful debt claims and instead pay $750 million paid back to its victims. The court’s ruling also required Centrelink to pay out an additional $111 million in compensation.

The majority of the $1.8 billion settlement for Centrelink victims covered the wiping of algorithm-fabricated unlawful debts and about $750 million the government paid back to victims. It also included $111 million in compensation, of which $10.3 million went to Gordon Legal for costs. All the billions and millions were taxpayer funded of course – none the politicians’ money.

In August 2022, Labor called a royal commission into the scheme, describing Centrelink’s Robodebt scandal as a “human tragedy”.

The $1.8 billion represents the equivalent of two years of Service NSW annual revenue. So, Services NSW CEO Greg Wells needs to starting read the daily news especially as it affect his constituent/voter base, get out more, and pull his aloof head in.

Else, he face a similar fate as Stuart Roberts and Sco-Mo. It’s down in the gutter with Centrelink’s automated robodebt witch-hunt of 2016. Read More: ^https://en.wikipedia.org/wiki/Robodebt_scheme

The NSW Governments’ Lockdown Compo Background

The NSW Government in late 2019 allowed a bonfire at Gospers Mountain to spread, ultimately destroying 80% of the Blue Mountains World Heritage Area, causing multiple state emergencies locking out all travel and tourism to the region.

Where was the NSW Emergency Services Minister David Elliott (below) at this critical time? In the midst of the bushfire crisis, Elliott reckoned he deserved a business class overseas holiday to the UK and France, delegating his job to NSW Prisons Minister Anthony Roberts to handle; all while Elliott luxuriated on a beach in the French Riviera.

NSW Premier Gladys Berejiklian was subsequently disgraced by keeping quiet about her boyfriend Daryl Macquire who happily took cash for dodgy VISA approvals. Berejiklian was forced to quit politics less than a year later on 30 September 2021 due to other misguided associations.

Meanwhile, Prime Minister Scott Morrison at the time also thought it ‘ok’ to abandon Australians enduring widespread bushfire crisis to obliviously holiday with family overseas in Hawaii.

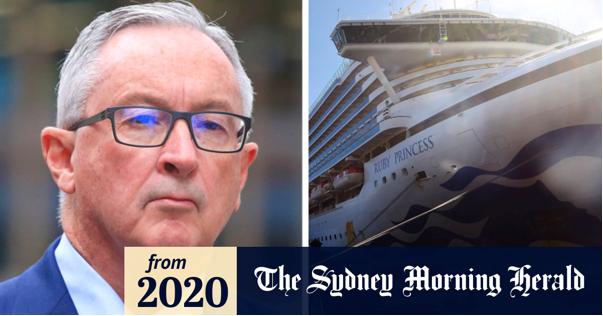

Then back-to-back from 19th March 2020, NSW Health Minister Brad (health?) Hazzard allowed 2700 passengers aboard the Carnival cruise ship ‘Ruby Princess’ berthed at Circular Quay in Sydney to disembark and spread the coronavirus pandemic throughout the local population.

Bradley (health) Hazzard – we recall him as the just a useless NSW Planning Minister for simplistic ‘one-size-fits-all’ NSW-wide Standardised Local Environment Plans.

Hazzard’s non-decision sparked two years of rolling socio-economic lockdowns throughout New South Wales (March 2020 through March 2022). His ineptness as Health Minister, the avoidable local COVID deaths that he allowed, and the catastrophic lockdowns mandatorily imposed on NSW locals, so should disqualify Hazzard from receiving any taxpayer-funded pension.

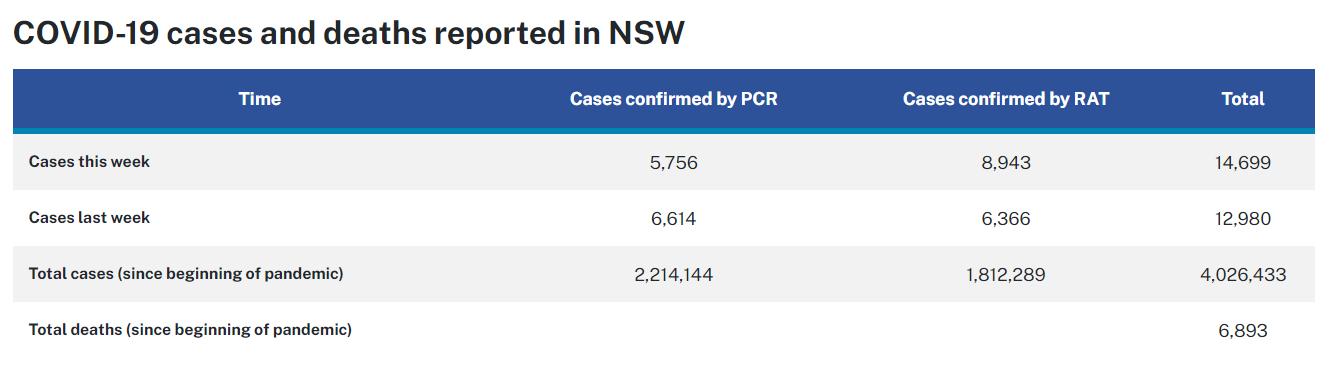

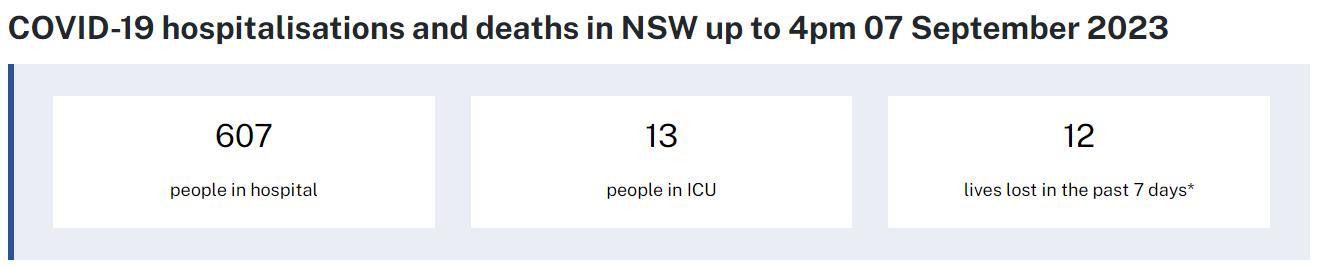

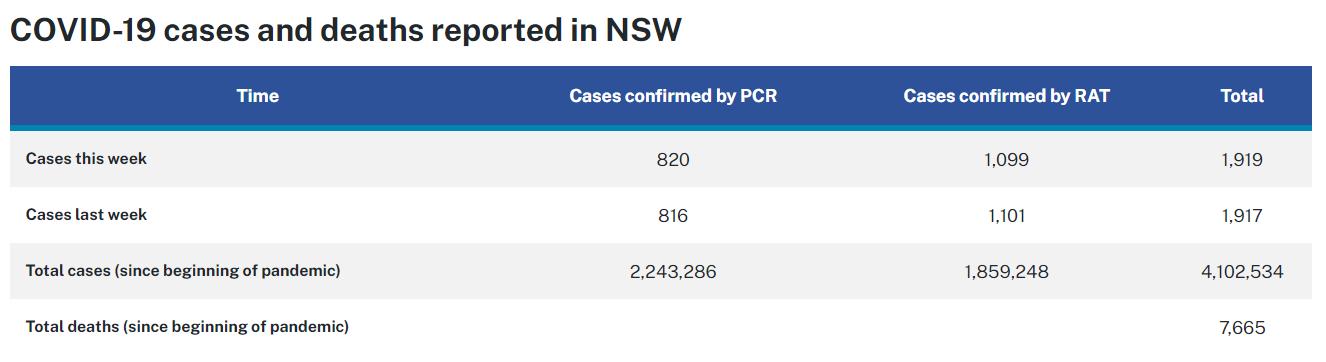

NSW has suffered 6893 deaths directly from the coronavirus pandemic since health Hazzard allowed infectious passengers to disembark the Ruby Princess cruise ship in Sydney. [Source: This is a daily dynamic table by Heath NSW (departmment), NSW Government, ^https://www.health.nsw.gov.au/Infectious/covid-19/Pages/stats-nsw.aspx#today]

Following both the Federal and NSW Governments’ failures to contain the coronavirus pandemic (COVID-19) from China in 2020, both governments imposed mandatory socio-economic lockdowns upon all citizens and businesses for two years – so denying individual liberties and the right of businesses to earn income.

Guilt-ridden by the quarantine failures, the NSW Government through its Services NSW cluster department in mid-2021 rolled out a number of financial compensation schemes to support impacted businesses, and this included its 2021 Micro Business Grant.

This amounted to a series of fortnightly payments of $1500 to eligible impacted business by the NSW Government as compensation to cover business expenses for the duration of the Greater Sydney lockdown. The total payments made between August and December 2021 totalled $15214. Apparently, Macquarie Street deemed its greater Sydney territory to annex adjacent rural New South Wales, minus any commensurate infrastructure funding.

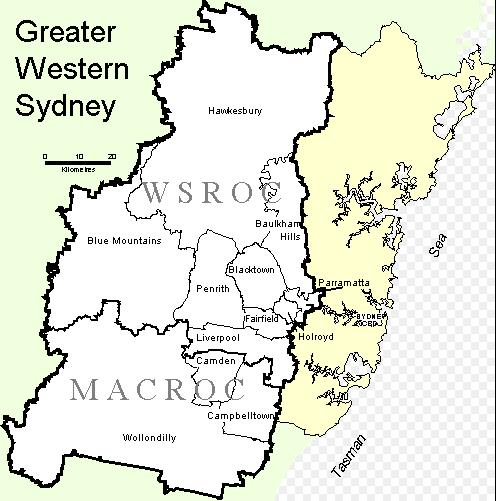

Check out Macquarie Street’s current map of its Romanesque ‘Greater Western Sydney’ annexation thus far:

Service NSW Micro Business Grant of 2021

Our business, Nature Trail commercially launched in August 2019 and due to the subsequent rolling government socio-economic lockdowns, remains a fledgling new tour operator in the Blue Mountains.

On 1st August 2021 we logically applied for the Service NSW offered Micro Business Grant for eligible businesses adversely impacted by the NSW Government’s pandemic lockdowns.

A key eligibility criterion for this grant was that a 100% reduction in turnover had to have been experienced by the business as a direct result of the NSW government’s pandemic lockdowns.

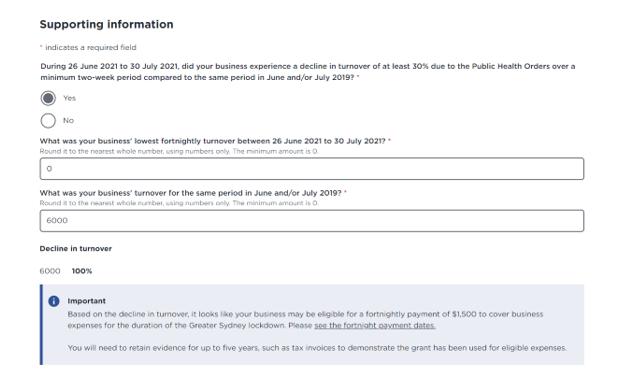

Yep..our official online lodgement extract duly recorded thus:

In accordance with the application, comparative business bank statements for the relevant periods were also duly included, as well as a copy of our business’s prior financial year’s business tax return.

Then some ten days later after Services NSW assessed our application, on 11th August 2021 we received email confirmation from Services NSW that our application for the Micro Business Grant funding had been formally approved by assessors. Compo funds then funds started flowing in without further question or conjecture. All good.

Service NSW under disgraced Premier Gladys Berijiklian is a bureaucratic cluster department that service only to double-handle the tasks of other government departments dealing with state registration fee of vehicles and businesses and collecting fines.

It has been Berijiklian’s cash cow, which is consistent with her dodgy boyfriend Darly Maquire MP’s ‘cash-for-fake-visas’ corrupt scheme. Maguire conspired with migration agent Maggie Sining Logan between January 2013 and August 2015 to help non-citizens fraudulently obtain visas.

Is Service NSW CEO Greg Wells on a grant claw-back commission or what?

Nature Trail, as a legitimate trading tour operating business in the Blue Mountains, and as a local tour operating business from December 2019 suffered a 100% turnover decline. This was directly as a consequence of the NSW Government’s abject failure to control both the widespread catastrophic Gospers Mountain Megafire 2019 state-wide emergency.

This was immediately followed back-to-back by the ensuing COVID-19 pandemic socio-economic lockdown mandatorily imposed by the NSW Government from 20th March 2020.

On 1st April 2020, Nature Trail applied for the NSW Government’s offered Micro Business Grant compensation funding to adversely impacted micro businesses. Service NSW then after assessment of this compensation grant application on 11th April 2020 approved this application.

Pandemic lockdown compensation funds were subsequently received from Service NSW over a a number of fortnights.

But then, mid-way, Service NSW suddenly changed their rules beyond the original terms and conditions so demanding that we had to confirm that we were still eligible to received the grant funds.

READ MORE:

Clearly, there had been some internal process stuff up within Service NSW’s approval and processing of the Micro Business Grant. It was nothing that we had done wrong, having honestly complied with all the eligibility criteria upon application, and subsequently honestly reporting any business revenue or staff number changes – of which there was none in our situation.

Fortunately, our micro business was not impacted by the unannounced payment freezes. NSW Government compensation funds were subsequently received into our business bank account.

But we empathise with those micro businesses that were impacted and left high and dry with only vague excuses supplied by Service NSW ‘customer service’ – if you could call it that.

Our Formal Complaint to Services NSW CEO Greg Wells

Sunday 16th April 2023

Mr Greg Wells

Chief Executive Officer

Service NSW

Level 2, 66 Harrington Street

THE ROCKS NSW 2000

Dear Sir,

MY FORMAL COMPLAINT AGAINST SERVICE NSW

RE: Service NSW 2022 COVID-19 Micro-Business Grant $15,214 – ‘an indian giving scam’ [ ref:_00D4a8aWL._5008v2oqsi:ref ]

SERVICE NSW REFS: Re-Assessor Reference SBRD2AGBE

(contact is ‘Angela’ with no surname provided)

Complaint Case #: 03731143

Customer Service Representative reference number 03868560

(contact is ‘Sam’ with no surname provided)

Grant Title: 2021 COVID-19 Micro-Business Grant

Reference number: COL-8718f31-MBS

Lodgement date: 2021-08-01

Grant

Approval date: 2021-08-11

Grant

Payment period: 2021-08-11 to 2021-12-10 (by total of 12 instalments)

1. As Managing Director, I hereby lodge my formal complaint against Service NSW for unconscionable conduct in relation to the following actions by its employee going by the name of ‘Angela’ (no surname) this week:A. Service NSW’s attempt to claim a refund of grant moneys (as a fee) after the fact that my eligibility criteria had been assessed by Service NSW and deemed to be met and then paid to me as compensation for the COVID-19 lockdown impact to my business;B. Services NSW’s unfounded claim that I am subsequently now “not eligible for the funding you received under this grant” being 1 year and 8 months after it was assessed and approved by Service NSW 11-Aug-2021) based on the factual information I provided on 1-Aug-2021. Accusing me of being guilty before even proven is contrary to natural justice. Service NSW wrongly thinks it can play judge, jury and executioner;C. Service NSW’s insecure communication methods to me out-of-the-blue in this matter, (mobile phone and email) including the inappropriate insistence that I provide my personal information to an anonymous ‘Angela’ person who phones me claiming to represent Service NSW;D. Service NSW’s wrong interpretation of my 2020 manual tax return to the ATO as copied and supplied to Service NSW in my 2021 grant application (now somehow not being “a real tax return”? – reflecting incompetence and ignorance by the Service NSW employee calling herself ‘Angela’ (read email 11-Apr-2023 copy below). I provide a link to the Australia Tax Office website which confirms that manual trust tax returns remain a legitimate and authorised means of submitting to the ATO https://www.ato.gov.au/forms/trust-tax-return-2022/E. Service NSW’s false presumption that I made “an incorrect, misleading or fraudulent claim” for the grant funding (read email 11-Apr-2023 copy below). This contradicts Services NSW approval of the application on 11-August 2021, irrespective of any one-sided terms and conditions clause; I made no false claim in my application.F. Service NSW’s implied threat by Service NSW to refer me to NSW Police for further action (read email 11-Apr-2023 copy below);G. Service NSW’s implied threat to refer me “If we do not hear from you, or if you do not provide the requested documentation by 26th April 2023 this matter will be referred to Revenue NSW to begin funds recovery” (read email 11-Apr-2023 copy below) is in my opinion, unconscionable. A two week deadline before Service NSW throws me to government debt collectors is unreasonable, especially given that the specific audit information requested by Angela is unclear to me.H. This recent correspondence from supposedly Service NSW claiming that I have been fraudulent, retrospectively and rejecting my eligibility for the 2021 pandemic grant compensation funding, and demanding that repay the $15214 in full else be referred to the NSW Government’s ‘Revenue NSW department debt collector is wrong, ill-informed, and highly stressful for me since I have done nothing wrong;I. I consider Service NSW’s employee behaviour towards me last week in its claim that retrospectively I am somehow ineligibly for the grant funding to be wrong and intimidating.SERVICES NSW’s RE-ASSESSMENT OF MY GRANT ELIGIBILITY… NEARLY 2 YEARS AFTER THE APPROVAL?

2. In reply to Service NSW’s email to me Tuesday 11th April 2023, yes, I confirm the business, Nature Trail, received in its dedicated business bank account the 2021 COVID-19 Micro-business Grant from services NSW totalling AUD $15,214 under this grant. A total of 12 instalments were received from Services NSW with the bank reference: ‘Direct Credit 624231 Service NSW MBS-08718f31-031dd’;3. I maintain that Nature Trail is a registered commercial business and was entirely eligible for this grant as a startup business catastrophically financial impacted by the COVID19 restrictions;4. I maintain that as Proprietor and Accountant of Nature Trail as a trading entity, I supplied all to Services NSW requested factual information and actual documentation to Services NSW as part of my application for this grant dated 1st August 2021;5. In response to my grant application, Service NSW assessed my application and assessed and approved Nature Trail’s eligibility for the grant on 11th August 2021. Services NSW then subsequently made grant payment instalments into Nature Trail’s business account. This included completing and submitting the online form and attaching the following documents:I. A copy of the FY2020 Trust Tax Return (for the business group which included Nature Trail) in full (20 pages) as lodged by me as the business accountant with the Australian Tax Office;II. A comparison profit and loss statement for Nature Trail FY 2020 with FY2020 (using QuickBooks accounting software and integrated with the ATO’s reporting requirements);III. Nature Trail bank statements for the reference periods, as requested by Service NSW in the original assessment process at the time of lodgement;IV. Copies of Nature Trail’s invoice records prior to the restrictions;V. NOTE: all such documentary evidence is able to be reproduced and re-submitted to Services NSW. I have nothing to hide.6. Since Services NSW approved the grant application on 11th August 2021, as sole representative for Nature Trail, the email (copy below) of Tuesday 11th April 2023 is the first communication I have received from Service NSW in relation to this grant challenging Nature Trail’s eligibility for this grant;7. My tour business Nature Trail was and remains severely adversely affected by the 2019-2020 NSW bushfire emergency lockdown and the 2020-2022 COVID-19 lockdown imposts. Both socio-economic disasters (bushfires and pandemic) were mostly attributable to gross negligence by the NSW Government. Nature Trail still has no overseas customer enquiries (Nature Trail’s target market) despite a healthy booking schedule pre-restrictions upon business trading launch.8. PUBLIC SERVANT REALITY CHECK NEEDED: I point out that the actual period of restrictions (mandatory socio-economic lockdowns) imposed by the NSW Government which severely adversely impacted the Nature Trail tour business (no customers) commenced from 19 December 2019 effectively back-to-back through to 30 November 2022 when the NSW Government lifted The Public Health (COVID-19 Care Services) Order (No 3) 2022 in the state of New South Wales. This period of course included 26 June 2021. A State of Emergency was declared for NSW on 19 December 2019 by Premier Gladys Berejiklian.This was the first of three in rolling lockdowns into late February 2020. From March 2020 the COVID-19 pandemic lockdown was similarly imposed by the Berejiklian Government for two straight years through to March 2022 and beyond.Public servants like Angela have continued to be paid their salary throughout the restrictions, all out of taxpayer wealth. In my view, many have no grasp of the financial impact to micro businesses like mine. Nature Trail’s decline in turnover was 100% from before the start of the restrictions, and since.9. Despite the lifting of the COVID-19 restrictions, Nature Trail’s business continue to suffer financial hardship – no overseas customer demand. If Service NSW persists with its baseless accusations of fraud and grant recovery then since I have no spare money, I will have no options but to apply for hardship and apply to the Hardship Review Panel.10. I have not ignored Service NSW’s supposed ‘audit’ inquisition. Rather, I have immediately contacted Services NSW to check the validity of this call by phoning Service NSW’s public number 13 77 88 on Wednesday 12-April-2023 and lodged a formal complaint (see reference above).I then tried phoning back on Thursday 13-April-2023 only to be told by the customer service person that she could not transfer me to the disputes resolutions team. I also arranged to speak to some Assessor at Services NSW, which I engaged with yesterday (14-April-2023) at 1pm. That re-assessor who phoned me insisted I first provide her with my personal details (just like a scam caller does).11. I confirm that I am the Tour Director of Nature Trail tour operation based in the Blue Mountains. Nature Trail is the trading name and the business owned by Wistmans Wood Trust [ABN 51 965 308 493]. The company trustee is Wistmans Wood Holdings Pty Ltd [ACN 600 331 931] and I am the sole director of the company.12. I confirm that as one of my skill sets is Management Accounting (following a 20 year corporate career in this specialised field). I am responsible for compiling the business bookkeeping and tax reporting for the Trust, which includes reporting the business activity of Nature Trail to the Australian Tax Office on a singular annual basis.Therefore, Services NSW demand that I provide “a letter from a qualified accountant, registered tax agent or registered BAS agent using the template provided by Service NSW” is unconscionable (read email 11-Apr-2023 copy below).I am not required by any law to engage the services of a registered tax agent to undertake tax reporting and related bookkeeping tasks. I am quite capable to doing these tasks myself. In fact, due to my business being under a legitimate discretionary trust structure, the tax accounting is quite complicated, and in my experience beyond the skillset of the average registered tax agent.13. I refer to contacts to me made supposedly by Service NSW since Tuesday 11th April 2023.The first was a call to my mobile phone by a woman saying her same was Angela and that she was from Service NSW and calling in regards to the Micro Business Grant of $15214 paid to me by Services NSW in 2022 and that I was now deemed to be ineligible to have received the grant monies, subject to an audit and had to refund the total.Angela insisted that she had to first identify me, yet it was her who had phoned me out of the blue, and she proceeded to ask me for my personal details. I said “no” and that I do not give my personal details to anyone who phones me.I treated this call as a scam and told her so. She said she would email me the details. I told her that scammers use phone and email methods of communication and that I would ignore both. I told her that if her claim was legitimate then I would receive a notification on my online account with Service NSW and then I hung up.14. I checked MyServiceNSW online account with Service NSW and no such audit notice was listed on my notifications. As at today, still no such audit notice is listed on my notifications. See below page extract.This online account facility was created by Service NSW for customers to use as a secure communications medium. Yet, if this audit is genuinely an initiative of Service NSW then why is the communication to me not reflected on Service NSW online account facility, but using the tool of scammers being by phone and email?15. I confirm that Nature Trail met all the Eligibility Criteria for Service NSW Micro-Business Grant at the time of application 1-August 2021, namely:A. ‘Nature Trail’ is a commercial business and had (and retains) an active ABN as at 1 June 2021 – check with ATO;B. Nature Trail as a startup business from August 2019, would reasonably qualify as a ‘micro-business’ trading but with minimal initial revenues and then catastrophically impacted first the bushfires emergency and then COVID-19 (zero revenues), so an application for this grant was made;C. Wistmans Wood Trust provided a copy of the original 20-page trust tax return for FY2020 to the Australian Tax Office to Services NSW as part of its application for the grant. The manual tax return is real, and Service NSW re-assessor Angela clearly has little or no understanding of tax returns. She needs to be re-educated. None other tax return exists for Nature Trail FY2020!D. Nature Trail was a new startup business from August 2019 primarily operating within New South Wales from that time through to including 1 June 2021 and beyond. As such, under the guidelines clause 6.8 (alternative circumstances) Nature Trail qualifies.E. Bank Statements to demonstrate decline in turnover: Nature Trail has its own dedicated bank account with the Commonwealth bank (local Katoomba branch nearby). Nature Trail, a startup new business, was not trading before August 2019. So there was no revenue in the period June 2019 as one option period requested by Service NSW. Nature Trail’s first customers paid into the bank account between September 2019 and December 2019.F. Decline in turnover – Nature Trail’s bank statements: I herewith re-supply these for the two weeks immediately prior to any restrictions of 12–25 June 2021 (inclusive) and a statement from the 2021 COVID-19 period of restrictions (commenced 26 June 2021). (see attached)G. Nature Trail still being a new startup business at the time of grant application, applied for the grant under guidelines 6.8 Alternative Circumstances “businesses not operating for the full year to 30 June 2020 (e.g. new businesses)” (also confirmed in ‘Attachment C: Alternative rules for businesses that do not meet standard eligibility criteria’) . This means that the $30,000 to $75,000 annual aggregate annual turnover range for pre-existing businesses did not apply.H. Under Australian Tax Law, Nature Trail was (is) not legally required to register for GST with the Australian Tax Office since the revenue was well below the $76,000 p.a. threshold. So Business Activity Statements (BAS) do not legally apply to Nature Trail, indeed not to any business applying for this grant since they would be earning over $76,000 p.a. as per the GST rules – one relishes that revenue earning obligation;I. Nature Trail as a tour operating business was a ‘highly impacted business’ as categorised under the grant Terms and Conditions Attachment A: List of highly impacted industries ‘Travel Agency and Tour Arrangement Services’ ( ANZSIC code 7220);J. Evidence of Decline in Turnover: Nature Trail experienced a total decline in turnover of 100% due to the public health order commencing 26 June 2021 (zero turnover) compared with an aggregate startup customer turnover of just $455 between business launch August 2019 and December 2019 when the Bushfire Emergency of Dec-2019 to Feb-2020 impacted back-to-back with the Pandemic lockdowns March 2020-March 2022 and beyond – which caused zero turnover to date. The lockdowns caused tour booking cancellations from clients that otherwise would have been some thousands of dollars. Pubic servants have no grasp of the reality of this catastrophic combined impact. Sales invoice documentary evidence is available upon request again, yet this was already supplied at the grant application time;K. No other government support compensation for COVID-19 lockdowns to Nature Trail’s business costs was available;L. As Tour Director I was the only employee (headcount) of Nature Trail at the time (from 31 July 2021) and remains so;M. Nature Trail at the time of application was (and remains) located in the Blue Mountains, a recognised NSW local government area which was deemed to be an adversely impacted at the time;N. Evidence of decline in turnover was duly supplied in the application. A comparative profit and loss statement comparing FY2020 to FY2021 report was supplied to Service NSW at the time of the application. If you lost this then that is not my fault. I have just regenerated a copy of this from the accounting system and I attach it for your reference again. (see attached)O. Nature Trail received no other income at the time;P. The received grant funds of $15214 were wholly applied to Nature Trail’s tour business – specifically to repairing and equipping the dedicated tour vehicle. All expense receipts are available upon request.Q. Every document and evidence I originally submitted to the Service NSW in apply for the grant was true and accurate. Everything I have done was wholly in compliance with the provided grant guidelines of the grant funding at the time of the application;16. If Service NSW considers that after-the-fact, some almost two years after it had assessed and approved the grant application, that it subsequently considers it now fell short of fully assessing the application, well frankly that is a matter for Service NSW to deal with its internal assessors. It legally is not my problem. I did all that was asked at the time, and it was under extremely difficult circumstances. Service NSW ‘Angela’ needs to pull her head in and back off.17. On Friday 14th April 2023 I requested the re-assessor ‘Angela’ provide a copy of the original terms and conditions of the grant and also clarify her specific demands after our phone conversation. She has failed to do both. So I have spent some hours this weekend to source the terms and conditions myself and reviewing them (copy attached) and preparing my herein response. I note that they have been inappropriately updated (changed) dated 7 October 2022, being nearly two months after my lodgement date. I have met the “conditions for payment under the Programme” (clause 4). Further, during the time of the grant payment process, I subsequently had to reconfirm eligibility, which I did on each required occasion. Yet such requirement was not included in the grant guidelines nor in the terms and conditions of the grant. Service NSW was making up the rules as it went along, after the approval date.18. I request Service NSW management promptly reflects on my above responses and information duly supplied (again).19. I insist that Service NSW immediately retracts its ridiculous baseless claims of fraud in its email to me below of 11 April 2023 (copy enclosed), and that it formally replies to me with an apology, and confirm in writing to me that Service NSW it has permanently cancelled its demand for any audit and refund from me. Angela in here email, in representing Service NSW, is abusing Service NSW unequal bargaining power against me. She needs to be appropriately disciplined by Service NSW management in relation to her ignorance, here based less accusations of fraud, and in her threatening tone towards me.20. This response to this audit is my first. I have spent all weekend feeling that I need to justify my legitimacy and it has been somewhat stressful for me. But I am not for being a victim. I will resist any intimidation and particularly governmental abusive Service NSW unequal bargaining power against me.21. Mr Wells being boss of Service NSW, I invite you to read and learn from the recent governmental bullying catastrophe of vulnerable citizens and seek your moral compass: ^https://www.abc.net.au/triplej/programs/hack/2030-people-have-died-after-receiving-centrelink-robodebt-notice/10821272Sincerely,Tour Director, Proprietor and Accountant for the business

Welcome support from Our local State member of Parliament

Loading...

Loading...

The above letter by our local member of New South Wales Parliament was very much appreciated, timely, well written and accurately representative of the reality being experienced by a number of Blue Mountains constituent businesses who had previously received the NSW Government’s grant compensation for this government’s lockdown.

We sincerely thank the Honourable Trish Doyle MP, Member for Blue Mountains for her welcome support of not just our Nature Trail tour business in this regard, but also learning that it has gone some way to also support the other similarly targeted eligible recipients of the Micro Business Grant.

In our parliamentary democracy we have in Australia, this role is exactly the core task of our elected local representatives at all levels of government.

Such parliamentary representation of local constituents is vital in cases such as this when departmental bureaucrats and their minions in power morph into a mindset of ‘Big Brother’ abuse of their delegated entrusted authority and presume they can hide behind some imagined cloak of auto-entitlement to intimidate ordinary citizens.

But Australia is not a dictatorship; it is a parliamentary democracy.

Nature Trail was quick to thank Ms Doyle’s office accordingly and we invite affected other businesses to do likewise.

Also, watch this space – we have received 227 reads of this particular Mountains Drums blog article of ours. We wrote and published it not about us, but rather so that other impacted businesses copping Services NSW grant claw back so-called “audit” may appreciate that they are not alone in this and like Nature Trail have a right to resist this ‘indian giving’ stance post the NSW change of government from Liberal to Labor parties.

Services NSW Spanish Inquisition type claw-back contrived debt recovery threats, approaching years post-eligibility approval of its applicant businesses for the Micro Business Grant is no less than an underhand revenue-desperate tactic, copycat of Centrelink’s notorious Robodebt – it’s akin to a Mark II Robodebt witch hunt.

Those in insulated government glass towers are too remote from real life on the streets.

Postscript:

27th July 2023:

Nearly three months later, the minister responsible for Services NSW decided to finally reply to the Member for Blue Mountains letter as follows:

Loading...

Loading...

So what do readers make of this response?

Our own critique of MP Jihad Dib’s Response

- Jihad Dib’s response is a very late – three months late!

- Jihad Dib MP is currently:

- NSW Labor Minister for Customer Service (i.e. Service NSW) and Digital Government

- NSW Labor Minister for Emergency Services

- NSW Labor Minister for Minister for Youth Justice

- NSW Labor Member for Bankstown electorate

So, NSW Labor Premier Chris Minns has Jihad Dib responsible for three ministerial portfolios. He can only focus on Service NSW ministerial duties up to one day a week. No wonder Dib’s response to us is 3 months late; he’s overloaded delegated trying to run three ministries!

- The Minns Labor government of NSW came to power on 25th March 2023. Following the intimidating accusations and threats that Nature Trail received from Service NSW from 11th April 2023, and following our responsive formal complaint to Service NSW CEO Greg Wells (who never responded to us), we also formally wrote to Minns minister The Hon. Rose Jackson, MLC on 17th April 2023. At the time Ms Jackson was delegated by Premier Minns as, wait for it…

-

- NSW Minister for Housing

- NSW Minister for Homelessness

- NSW Minister for Water

- NSW Minister for Mental Health (she might need support herself)

- NSW Minister for Youth

- NSW Member for North Coast electorate (when she gets time)

- …NSW Minister for pulling her hair out ??

- Jihad Dib’s response is an empty non-committal response.

- It offers no decision, no apology, no regret for the abuse of Jihad Dib’s Service NSW department.

- It is but a bureaucrat’s non-answer putting a smile on the assassins’ ongoing witch hunt, only for his staff to smile as they resume their unfounded persecution of presumed fraud and while twisting the knife in to business owners genuinely adversely impacted by the government lockdowns and assessed and deemed eligible for the NSW Government’s Micro Business Grant.

Guess where Jihad Dib’s Service NSW office is? The same as that of NSW Treasury.

We continue our critique of MP Jihad Dib’s response letter:

- Minister Dib: “I acknowledge the frustration that the process is causing customers” – “Frustration”? No! How ignorant and condescending of you, Dib. How about Service NSW’s outsourced debt collectors’ exposed for wrongful presumption of fraud of businesses and intimidating threats toward us, despite Service NSW having assessed and deemed eligible prior to the grant approval and payments?

- Minister Dib: “However, Service NSW must ensure that delivery of monies by the NSW Government is done with fairness and to the highest ethical standards, ensuring equity for all NSW citizens.” Don’t motherhood us, Dib. Check your facts that Service NSW assessed and approved our grant application after 10 days. Service NSW subsequent fabricated claim that its grant approval process was “automated” at the time is a blatant lie. Yes, delivery of monies by the NSW Government was done with fairness in our case, but for many businesses not so, which suffered not notified cessation of grant payment instalments without notice. We see no ethical standards by Service NSW debt collectors almost two years after the grant compensation was long approved, paid out and duly received.”

- Minister Dib: “I have been advised by Service NSW that during the COVID-19 pandemic, the Premier prioritised a cash injection to businesses in NSW in the face of the Delta outbreak and NSW lockdowns.” Yes.

- Minister Dib: “In order to ensure swift payment so that customers were assisted promptly, some businesses were automatically assessed based on the self-declaration that they provided at the time of application.” Not for Nature Trail. Our eligibility and online application was assessed over a ten day period by Service NSW and then approved.

- Minister Dib: “As per the grant’s Terms and Conditions, grants that were automatically assessed were later scheduled for manual assessment.” Not for Nature Trail.

- Minister Dib: “These reassessments started in 2022 and are continuing, and customers who missed providing evidence with their initial application are being asked to substantiate their claims.” Not for Nature Trail. We copped the intimidating accusations and threats from Service NSW’s outsourced debt collectors from 11 April 2023, just over two weeks after the NSW state election. Clearly Minns Labor was chaffing at the bit to desperately fund its programmes by hook or by crook.

- Minister Dib: “Service NSW conducts these reassessments to confirm that the correct funds were released to customers based on the grant’s eligibility criteria.” Nature Trail was fully assessed by Service NSW and deemed eligible to receive the Micro Business Grant compensation from the NSW Government on 11th August 2021.

- Minister Dib: “Service NSW acknowledges that they have received complaints about the tone of communications. They have reviewed the tone and content of correspondence used when advising customers of the commencement of grant audits. They have also reviewed how customers can confirm the legitimacy of correspondence received from Service NSW.” No, it is not about the “tone” of Service NSW outsourced communications to debt collectors. Rather, try wrongful presumption of fraud, and intimidating threats such that “otherwise we will refer you to Revenue NSW debt collectors and then you will know it!” (Robodebt Mark II)

- Minister Dib: “I have been advised that Service NSW will continue to carry out reassessments and Service NSW has confirmed that they have changed both the correspondence and the process, providing customers with support and options to provide the evidence missing off their files.” So Dib, despite all your conciliatory waffle above, yet no apology from you noted, you have endorsed Service NSW and its debt collection endeavours to continue to carry out reassessments” irrespectively.

Former Islamic school teacher Jihad Dib MP, is the NSW Minister responsible for NSW Government public service delivery, branded ‘Service NSW’

Jihad by name or Jihad by nature? What a name choice downunder?

Debt collecting of approved and paid grant funding is non-debt, so the decision to debt collect is unconscionable by Service NSW CEO Greg Wells.

In our view, Service NSW CEO Greg Wells needs to immediately cease Service NSW’s debt collection programme against innocent recipients like us, to publicly apologise for his wrongs in this debacle and should to resign as CEO of Service NSW immediately.

Services NSW needs to be wound up and the public service staff re-deployed back to the various service departments, so doing away with the umbrella and the veil.

Further Reading:

July 2021 (we retain an original copy of these from this date, rather than the changes guidelines last Last updated on the Services NSW website “7 October 2022” which has changed the original guidelines.

https://www.millsoakley.com.au/thinking/nsw-under-official-lockdown-full-details-of-new-government-directions-now-published/

“With the outbreak of the Delta variant of COVID-19 showing no signs of easing, small businesses support payments will help many businesses trade through the disruption.…COVID-19 micro-business support grant…To be eligible, businesses need to show they experienced a decline in revenue of 30% or more and that a person associated with the business is reliant on the business for income. Applications are open and will close on September 13.”

‘Audits of the 2021 Job Saver payments, COVID-19 Business grants, Micro-business grants, Accommodation Support grant & Commercial Landlord Hardship Fund have started.

Revenue NSW is conducting these audits on behalf of the NSW Government.

Under the Terms and Conditions of applying for these payments and grants, applicants agreed they may be subject to an audit, and would participate in the process if requested.

The process

We will use external agency information to data match against details provided by applicants for each of the grants to identify customers who may not have met the eligibility requirements.

If your application is selected to undergo a review, you will first be contacted by phone and told that the review is being done. You will then receive written confirmation from us, including our contact details and next steps.

You will be kept up to date on the review’s progress. You may be asked to supply further documents to support your eligibility.

We will contact you when the review is completed and tell you the outcome, as well as explain the reasons for that decision. The outcome could be ‘no further action’, or that we believe there has been an under or over payment.

If we believe there was an over payment, we will provide you with another opportunity to demonstrate eligibility for the money you received. We will also explain the process to recover any over payment.

If there was an under payment, we will organise for the funds to be credited to your nominated bank account.’

AUTHOR’s NOTE:

- Nature Trail provided all that was asked by Service NSW (before, during and afterwards, including further documents supporting our eligibility for the grant.)

- But no, we have never been kept up to date on the review’s progress by Service NSW.

- We are yet to be contacted by Service NSW to know whether its ‘audit review’ is completed or not, thus we remain in limbo by Service NSW presumably deliberately.

‘Service NSW has been urged to stop tweaking the rules around its COVID-19 business support measures, as accountants struggle to keep up with ever-evolving and inconsistent guidelines.

The state agency responsible for administering the COVID-19 Business Grant, Micro-business Grant and the JobSaver payment has now changed its alternative turnover comparison period from 11 to 25 June 2021 to 12 to 25 June 2021 to ensure the period was 14 days instead of 15 days.

The tweak comes just days after Service NSW introduced two alternative comparison periods for determining the decline in turnover.

Service NSW has also removed the word “national” that preceded the term “aggregated annual turnover” throughout the guidelines, and removed the requirement that a business must be GST-registered to apply for financial support.

It has also changed the accountant’s letter template for the COVID-19 Business Grant and the Micro-business Grant to specify that accountants will have to certify that the decline in turnover of a business is due to the public health order.

The Tax Institute’s senior advocate, Robyn Jacobson, said it was disappointing to see the rules still being changed seven weeks into the state’s lockdown.

She said the ever-evolving guidelines meant businesses were left wondering if they were eligible for any support, while putting practitioners on the backfoot when advising clients.

“This has to stop,” Ms Jacobson told Accountants Daily. “Accountants and businesses, who have been extremely agile and accommodating as the intermediaries throughout the pandemic, are frustrated with the lack of certainty on the eligibility requirements for the NSW COVID-19 support measures.“We certainly acknowledge the challenge faced by the NSW government, which has had to quickly respond to the fluid health situation, but it is equally challenging to correctly advise businesses when the rules keep changing.”

Ms Jacobson, who has been tracking the guidelines since they were first released, said changes were often unannounced and updated at different times, and in some cases, reflected in one form of web guidance but not another, making it hard to determine the correct position.

She said the most recent changes were significant, particularly the changes to the accountant’s letter template.

“While accountants are comfortable with certifying a mathematical decline in turnover, a number of members of The Tax Institute have provided feedback that they consider the new certification unreasonable, or feel they are not in a position to certify that the decline in turnover is due to the public health order,” said Ms Jacobson.

The changes to the turnover comparison period and the aggregated turnover definition could also have a significant impact on a business’s eligibility, with Ms Jacobson noting that Service NSW had failed to provide advice to businesses who had applied for the support payments based on previous guidelines.

“There is still no clear pathway for businesses who have applied for support based on a previous version of the guidelines, but under the revised guidelines may be entitled to a greater level of support, less support or may indeed now be ineligible,” said Ms Jacobson.

“It is not clear how these businesses should request a review of or amend their submitted applications so that they reflect the revised rules.